In the economic analysis of organizations, managerial decisions in an organization are efficient when these decisions maximize net benefits to the organization (that is, net private benefits). These privately efficient decisions are said to be socially efficient when they also maximize net benefits to society (that is, net social benefits). In the typical analysis all benefits and costs considered are economic.

This approach is characterized as unbounded rational optimization, based on the assumptions of a perfectly competitive market economy.1 A market so defined works smoothly as producers (sellers) and consumers (buyers) interact. Their individual decisions, based on self-interest to achieve their own objectives, ultimately direct resources to the use most highly valued by both groups (society). That is, the decisions that maximize private net benefits also maximize social net benefits, or eco- nomic welfare, to that society that consists of producers and consumers in the market. This outcome is Pareto optimal because no one individual can gain without imposing a cost on someone else. The efficient decision process that achieves Pareto optimality occurs as a response by produc- ers and consumers to input market prices of the resources required in production and to output market prices of the goods and services produced. Prices, that is, relative prices, are the signaling devices that make this economic system work.

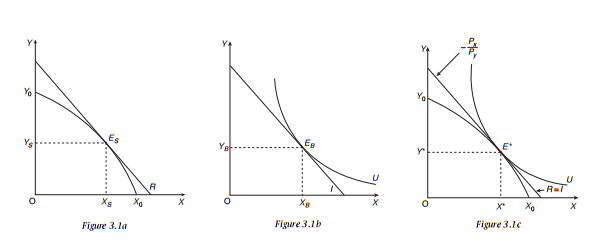

Figure 3.1 illustrates both the simplicity and the power of this model of an efficient economic system that produces two goods, X and Y, and which trade in the market at prices px and py. Figure 3.1a shows the out- come of the decision process of sellers who have responded to relative factor prices to minimize their production costs. Given resource and technology constraints shown by the curve Y0 X0 and the market prices px and py, sellers choose the quantities XS and YS produced at minimum production cost to achieve maximum economic profit (π). This is shown by the equilibrium point ES on revenue line R.

Figure 3.1b shows the outcome of efficient decision making by con- sumers in this economy. Given their income endowment and market goods prices px and py, consumers would choose to buy the quantities XB and YB to obtain maximum satisfaction or utility (U). This is shown by the equilibrium point EB on indifference curve U.

The combined outcome of these separate sets of decisions is shown in Figure 3.1c. E* is a general equilibrium in this market economy. It is the position of greatest profit for all producers and the most satisfaction for all consumers, achieved through the voluntary exchange of the quanti- ties of X* and Y* at their equilibrium market prices, p*x and p*y . At the general equilibrium E*, XS = XB and YS = YB. If the desired amounts of production and consumption were not equal producers and consumers would bargain, altering prices px and py until the interests of all parties were aligned at the new equilibrium market prices shown. The model shows competitive producers as efficient profit maximizers, competitive consumers as efficient utility maximizers, and the competitive market system as an efficient organization of production and consumption through multiple efficient transactions.

This simple model of efficient decision making in a competitive mar- ket can be applied to decision making in a complex individual organiza- tion. A complex organization is taken here to be one that involves a hierarchical structure, which in the simplest case involves three levels: owners/investors, manager, and workers (that is, production labor). My interest here is in the relationship between owners and manager, where the manager is a utility maximizing agent who makes decisions on behalf of the owners/investors. I consider each of the three organizational forms: for-profit corporation, public bureau, and nonprofit organization.

1. For-profit corporation

In a simple view of the corporate structure, owners are shareholders and managers are the decision makers. In terms of Figure 3.1, X and Y rep- resent two decision variables. For example, X may be expansion of internal information/technology services and Y may be product adver- tising. In this case curve Y0X0 represents the possible combinations of these two activities from committing corporate resources to each. Line R represents the expected return to owners from investing in each activ- ity, and the prices represent the opportunity costs associated with each activity. The general equilibrium E* maximizes owner returns and is achieved under conditions of perfect agency, where managerial prefer- ences are aligned with those of owners, and managerial utility is there- fore also maximized.

If the assumptions of the competitive model do not hold for organi- zational decision behavior, then managerial preferences may differ form those of owners, and E* would not obtain. For example, if the manager has a relative preference for advertising, the indifference curve would reflect this. The managerial equilibrium (which would be analogous to the consumer equilibrium in Figure 3.1b) would occur at a point to the left of E*, an outcome that would yield lower profit for shareholders than their desired maximum. Such situations are examined in detail in Chapter 5.

2. Public bureau

In a simple view of a public sector organization, the bureau, owners are the citizens or taxpaying public as represented by legislators who provide funding for the bureau. Legislators fund the bureau with some expected return which may be pecuniary, such as increased campaign contribu- tions from constituents, or nonpecuniary, such as increased constituent benefits or votes.

In terms of Figure 3.1, X and Y represent two decision variables as before. For example, X may be the number of inspections of meat processing facilities and Y may be the level of agricultural conservation subsidies. In this situation curve Y0X0 represents the possible combina- tions of these two activities from committing public resources to each. Line R represents the expected return to legislators from investing in meat inspections and agricultural conservation, and the prices represent the opportunity costs associated with each. The general equilibrium E* here maximizes legislator returns and is also achieved under conditions of perfect agency, where bureau managerial preferences are aligned with those of legislators and bureau managerial utility is therefore also maximized. This outcome derives from the bureau competition for legislative funds and the additional assumptions that (1) legislators accurately represent public interests and (2) bureau managers serve the public interest.

Again, if bureau managerial preferences differ from either legislative or public preferences then E* will not obtain. Such situations are exam- ined in detail in Chapter 6.

3. Nonprofit organization

Legal ownership is absent in the nonprofit organization; there are neither shareholders nor public ownership. There are, however, indi- viduals who have a stake, or strong interest, in the organization, such as donors, whom we may refer to as stakeholders. Donors/stakeholders invest funds in the nonprofit organization with an expected return that may be pecuniary, such as a tax reduction benefit, or nonpecuniary, such as the benefit of having specific services provided to some third party.

In terms of Figure 3.1, X and Y represent two decision variables faced by the nonprofit manager. For example, X may be the variety of services provided, such as counseling, care giving, or financial aid, and Y may be the quality of each service. Curve Y0 X0 represents the possible combi- nations of these two decision choices from committing donor funds to each. Line R represents the expected return to donors/stakeholders from investing in the variety and quality of services, and the prices represent the opportunity costs associated with each decision variable. The gen- eral equilibrium E* here maximizes donor/stakeholder returns and is also achieved under conditions of perfect agency, where nonprofit managerial preferences are aligned with those of donors and nonprofit managerial utility is therefore also maximized. This outcome derives from the assumption of nonprofit competition for donated funds.

As before, if nonprofit managerial preferences differ from those of donors then E* will not obtain. Such situations are examined in detail in Chapter 7.

Source: Carroll Kathleen A. (2004), Property Rights and Managerial Decisions in For-Profit, Nonprofit, and Public Organizations: Comparative Theory and Policy, Palgrave Macmillan; 2004th edition.