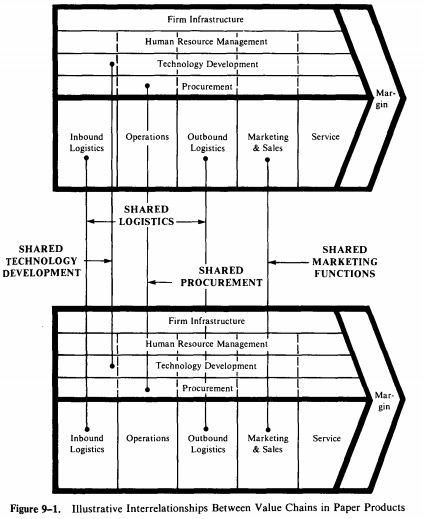

The value chain provides the starting point for the analysis of tangible interrelationships. A business unit can potentially share any value activity with another business unit in the firm, including both primary and supporting activities. For example, Procter & Gamble enjoys interrelationships between its disposable diaper and paper towel businesses. Certain raw materials can be procured and handled jointly, the development of technology on products and processes is shared, a joint sales force sells both products to supermarket buyers, and both products are shipped to buyers via the same physical distribution system. The interrelationships are shown schematically in Figure 91. As this example illustrates, tangible interrelationships between two business units can involve one or many value activities. If most value activities are shared between two business units, however, they are not strategically distinct business units but in fact one business unit.

Sharing an activity can lead to a sustainable competitive advantage if the advantage of sharing outweighs the cost, provided the sharing is difficult for competitors to match. Sharing leads to a competitive advantage if it reduces cost or enhances differentiation. Sharing always involves some cost, however, that ranges from the cost of coordinating among the business units involved to the need to modify business unit strategies to facilitate sharing.

1. Sharing and Competitive Advantage

Sharing a value activity will lead to a significant cost advantage if it involves an activity that represents a significant fraction of operating costs or assets (I term this a large value activity), and sharing lowers the cost of performing the activity. Sharing will significantly enhance differentiation if it involves an activity important to differentiation in which sharing either increases the uniqueness of the activity or reduces the cost of being unique. Thus sharing leads to a competitive advantage if it affects the drivers of cost position or differentiation described in Chapters 3 and 4.

Sharing will have a material impact on overall cost position only if the value activities involved are a significant proportion of operating costs or assets, or will be in the future. In the Procter & Gamble example, the shared value activities add up to more than 50 percent of revenues. Sharing does not necessarily lower cost, however, unless it favorably affects the other cost drivers of an activity. Sharing has the potential to reduce cost if the cost of a value activity is driven by economies of scale, learning, or the pattern of capacity utilization.70 Sharing increases the scale of an activity and increases the rate of learning if learning is a function of cumulative volume.71 Sharing may also improve the pattern of capacity utilization of an activity if the involved business units utilize the activity at different times. For example, a sales force or logistical system that is utilized heavily during only part of the year serving one business unit may be utilized during other periods by another. All three benefits of sharing for cost position can potentially occur simultaneously.

Sharing activities among business units is, then, a potential substitute for market share in any one business unit. A firm that can share scale- or learning- sensitive activities among a number of business units may neutralize the cost advantage of a high market share firm competing with one business unit. Sharing is not exactly equivalent to increasing market share in one business unit, however, because a shared activity often involves greater complexity than an equivalent scale activity serving one business unit. The complexity of a shared logistical system involving ten product varieties may increase geometrically compared to one that must handle only five. The added complexity becomes a cost of sharing.

If scale, learning, or the pattern of utilization are not important cost drivers, sharing is likely to raise costs. Firms often mistakenly pursue sharing solely because of excess capacity in an activity. If shar-ing does not lead to scale or learning advantages or improve the longterm pattern of utilization, however, the costs of sharing will usually mean that sharing creates a disadvantage. The correct solution would have been to reduce capacity in the activity rather than share it.

Figure 9-2 illustrates how these principles can be used to highlight activities where sharing is potentially important to cost position. Inter- relationships involving value activities in the upper right-hand quadrant of the diagram are of potentially greatest significance due to their large costs and sensitivity to scale, learning, or utilization. Interrelationships involving value activities in the upper left-hand quadrant are not currently important because sharing will not reduce cost, though the value activities represent a large fraction of costs or assets. However, changes in the technology for performing such activities can quickly make interrelationships crucial if their cost becomes more sensitive to scale, learning, or utilization. The change in order processing technology from manual systems to on-line computers in many distribution industries, for example, has begun to create important advantages from sharing order processing across related product lines. Interrelationships involving value activities in the lower right-hand quadrant can become important for cost position if changes in the cost structure raise the percentage of operating costs or assets they represent. The increasing capital cost of a plant and supporting infra-structure, for example, will raise the potential advantage of sharing facilities.

Figure 9-2. Shared Value Activities and Cost Position

SHARING AND DIFFERENTIATION

Sharing affects differentiation in two ways. It can enhance differentiation by increasing the uniqueness of an activity, or it can lower the cost of differentiation. Chapter 4 described how many activities can affect buyer value and, thus, differentiation. Sharing will be most important to differentiation if it affects value activities that are important to actual value or to signaling value. In consumer electronics, for example, sharing product development is important to differentiation because differentiation is heavily affected by product design. Sharing will also be important to differentiation where it reduces the cost of expensive forms of differentiation, such as an extensive sales and service network (e.g., IBM in office products).

Sharing can make an activity more unique both directly and through its impact on other drivers of uniqueness. Sharing enhances uniqueness directly if the shared activity is more valuable to buyers because it involves more than one business unit. Selling several products through the same sales force may increase convenience for the buyer, for example, or allow for the differentiation advantages of bundling (see Chapter 12). In telecommunications, for example, buyers want system solutions and one-vendor accountability. Similarly, joint product development may lead to greater compatibility among related products. Sharing may also increase uniqueness indirectly, through increasing scale or the rate of learning in an activity. As described in Chapter 4, both scale and learning may allow an activity to be performed in a unique way.

Sharing can reduce the cost of differentiation through its impact on the cost drivers of differentiating activities. Sharing product development among business units can reduce the cost of rapid model changes if product development is subject to economies of scale, for example, while shared procurement can lower the cost of purchasing premium quality ingredients or components. The added complexity of a shared activity is a cost of sharing, however, that must be weighed against the benefits to differentiation.

THE ADVANTAGES OF SHARING AND BUSINESS UNIT POSITION

Sharing an activity will usually not lead to an equal improvement in cost or differentiation for each of the business units involved. Differ-ences in the scales of the business units are one important reason. A business unit that uses a large volume of a component may not gain much of a cost advantage from sharing fabrication of the component with a business/ unit that uses a small volume of it. However, the unit that is the smaller user may enjoy a tremendous improvement in cost position through gaining the benefits of the larger unit’s scale. The advantages to the unit that is the smaller user may allow it to substantially improve its market position. Given such asymmetries, it should come as no surprise that larger business units are rarely enthusiastic about interrelationships with smaller units.73

Differences in the structure of the industries in which business units compete may also lead to differential benefits from sharing. A small improvement in cost position may be very important in a commodity industry, for example, but less significant in an industry where product differentiation is high and firms compete on quality and service. The significance of an interrelationship also depends on the strategies of the business units involved. An interrelationship may lead to uniqueness that is valuable for one business unit but much less valuable to another. It is rare, then, that all the business units involved in an interrelationship will perceive it as equally advantageous. This point has important implications for horizontal strategy and for the ability of senior managers to persuade business units to pursue interrelationships.

2. The Costs of Sharing

Interrelationships always involve a cost, because they require business units to modify their behavior in some way. The costs of sharing a value activity can be divided into three types:

- cost of coordination

- cost of compromise

- cost of inflexibility

The cost of coordination is relatively easy to understand. Business units must coordinate in such areas as scheduling, setting priorities, and resolving problems in order to share an activity. Coordination involves costs in terms of time, personnel, and perhaps money. The cost of coordination will differ widely for different types of sharing. A shared sales force requires continual coordination, for example, while joint procurement may require nothing more than periodic communication to determine the quantity of a purchased input required per period by each business unit. Different business units may also see the cost of coordination differently. The costs of coordination are often viewed as higher by smaller business units, who see a continual battle over priorities and the risk of being dictated to by larger units. Business units that do not manage a shared activity or are located at a distance from it also tend to fear that their best interests will not be protected.11

The cost of coordination will be influenced by the potentially greater complexity of a shared activity noted earlier. The added complexity involved in sharing will vary, depending on the specific activity. Sharing a computerized order entry system among business units will usually add little complexity, for example, in contrast to sharing a logistical system between two business units with large product lines. The added complexity of a shared activity can sometimes offset economies of scale or reduce the rate of learning compared to an activity serving one business unit. Thus sharing can both increase scale and/ or learning at the same time as it alters the relationship between scale or learning and cost. This is important because changing the scale- or learning-sensitivity of an activity may benefit or hurt the firm’s cost position depending on its circumstances. Computerization generally has reduced the cost of handling the complexity of sharing. That is one of the reasons why interrelationships are getting more important.

A second, often more important, cost of sharing is the cost of compromise. Sharing an activity requires that an activity be performed in a consistent way that may not be optimal for either of the business units involved. Sharing a sales force, for example, may mean that the salesperson gives less attention to both business units’ product and is less knowledgeable about either product than a dedicated sales force would be. Similarly, sharing component fabrication may mean that the component’s design cannot exactly match one business unit’s needs because it must also meet another’s. The cost of compromise may include costs not only in the shared value activity but also in other linked value activities. Sharing a sales force, for example, may reduce the availability of salespeople to perform minor service functions, thereby increasing the number of service technicians required. Policy choices required to facilitate sharing, then, can adversely affect the cost or differentiation of one or more of the business units involved.

That business units must in some way compromise their needs to share an activity is almost a given. The cost of compromise may be minor, or may be great enough to nullify the value of sharing. For example, attempting to share a logistical system among business units producing products of widely differing sizes, weights, delivery frequencies, and sensitivities to delivery time may well lead to a logistical system that is so inappropriate to any of the business unit’s needs that the cost savings of sharing are overwhelmed. However, sharing a brand name or sharing procurement of commodities may involve little or no compromise.

The cost of compromise to share an activity will often differ for each of the affected business units. A business unit with a product that is difficult to sell may have to compromise the most in employing a shared sales force, for example. The cost of compromise may also differ because the particular value activity plays a differing role in one business unit compared to another because of its strategy. The compromise involved in joint procurement of a common grade of milk or butter may be more serious for a business unit of a food manufacturer pursuing a premium quality strategy than it is for one attempting to be the low-cost producer if the common grade is not top quality.

The cost of compromise required to achieve an interrelationship is much less if the strategies of the business units involved are consistent with respect to the role of the shared value activity. Achieving such consistency often involves little or no sacrifice to the affected business units if their strategic directions are coordinated over time. A particular component can be highly effective in the products of two business units if both units design their products with the component in mind, for example. If the design groups of the two business units are allowed to proceed independently, however, the chances are high that the common component will not meet either business unit’s needs. Consistency among business units’ strategies that facilitates sharing will rarely happen naturally. An example of both the opportunities to shape the cost of compromise and the indirect costs of compromise that must be weighed comes from General Foods’ successful new Pudding Pops. Pudding Pops were designed to melt at a higher temperature than ice cream so that distribution then could be shared with General Foods’ Birds Eye frozen vegetables. While frozen foods are transported at zero degrees Fahrenheit, ice cream must be transported at 20 degrees below zero or it will build up ice crystals. While the benefits in shared logistics were clear, however, sharing had some unforseen consequences elsewhere in the value chain. Because Pudding Pops had to be ordered by supermarket frozen food managers along with vegetables, instead of with other freezer case novelty items, Pudding Pops were often forgotten. As this example illustrates, the benefits and costs of an interrelationship must be examined throughout the value chain and not just in the activity shared.

The cost of compromise is frequently reduced if an activity is designed for sharing rather than if previously separate activities are simply combined or if an activity designed to serve one business unit simply takes on another with no change in procedures or technology. Recent events in financial services have highlighted this point. Merging computer systems initially designed for separate financial products has proven difficult, though a system designed to process many products would be effective. Similarly, attempting to sell insurance and other financial products through a distribution system designed for selling stocks and bonds has not served any of the products very well and has created organizational problems. However, a new conception of a brokerage office is emerging that combines brokers, customer service personnel to handle simple problems and screen clients, and specialists to sell other financial products together with a new shared information system. The cost of compromise in sharing distribution is likely to be much less as a result.

The third cost of sharing is the cost of inflexibility. Inflexibility takes two forms: (1) potential difficulty in responding to competitive moves, and (2) exit barriers. Sharing can make it more difficult to respond quickly to competitors because attempting to counter a threat in one business unit may undermine or reduce the value of the interrelationship for sister business units. Sharing also can raise exit barriers. Exiting from a business unit with no competitive advantage may harm other business units sharing an activity with it.74 Unlike other costs of sharing, the cost of inflexibility is not an ongoing cost but a potential cost should the need for flexibility arise. The cost of inflexibility will depend on the likelihood of the need to respond or exit.

Some costs of coordination, compromise, or inflexibility are involved in achieving any interrelationship. These costs, particularly any required compromise to achieve an interrelationship, will be very real concerns raised by business units when sharing is discussed. They may appear far more obvious than the advantages of the interrelationship, which may appear theoretical and speculative. Business units will also tend to view a potential interrelationship in the light of their existing strategy, rather than weigh its cost if their strategies are modified to minimize the costs of sharing. Finally, the value of interrelationships is often clouded by organizational issues involved in sharing, including those of turf and autonomy which are addressed in Chapter 11. Thus business units can sometimes oppose interrelationships that may result in a clear competitive advantage to them.

The advantages of sharing an activity must be weighed against the costs of coordination, compromise, and inflexibility to determine the net competitive advantage of sharing. The assessment of the competitive advantage from an interrelationship must be performed separately for each of the involved business units, and the value of an interrelationship to the firm as a whole is the sum of the net advantages to the involved business units. The net competitive advantage from sharing an activity will almost inevitably vary for each business unit involved. In some cases, the net value of an interrelationship may even be negative from the viewpoint of one business unit because of the required compromise, but will be more than offset by a positive net value for other affected business units. For this reason and because of the natural biases in approaching interrelationships noted above, then, business units will often not readily agree on pursuing interrelationships that will benefit a firm as a whole. Interrelationships will only happen under such circumstances if there is an explicit horizontal strategy.

While there are always costs of sharing, forces are at work to reduce them in many industries. The new technologies described earlier in this chapter are having the effect of reducing the cost of coordination, compromise, and, to a lesser extent, the cost of inflexibility. Easier communication and better information systems make coordination easier. Low-cost computers and information systems also introduce flexibility into value activities, or the technical capability to minimize the cost of compromise. Programmable machines and robots can adapt to the different needs of business units sharing them. Many firms are only beginning to perceive these possibilities for lowering the cost of sharing, but continue to base their assessment of interrelationships on outdated methods.

3. Difficulty of Matching

The sustainability of the net competitive advantage of an interrelationship will depend on the difficulty competitors have in matching it. Competitors have two basic options in matching the competitive advantage of an interrelationship: (1) duplicating the interrelationship,or (2) offsetting it through other means such as gaining share in the affected business unit or exploiting a different interrelationship. The ease of duplicating an interrelationship will vary depending on whether competitors are in the same group of related industries involved. The most valuable interrelationships from a strategic point of view are those involving industries that competitors are not in and that have high barriers to entry. For example, Procter & Gamble’s advantage from the interrelationships between its disposable diaper and paper towel business units is quite sustainable because its paper towel competitors are blocked from entering the diaper business by enormous entry barriers. A competitor may also face higher or lower costs of coordination and compromise than the firm in achieving an interrelationship depending on the strategies and circumstances of its business units. Other things being equal, then, a firm should pursue most aggressively those interrelationships that its competitors will find the most difficult to match because of the costs of coordination or compromise.

The ability of competitors to offset an interrelationship is a function of whether they can find some other way of improving position in the affected business unit through changes in its strategy or by pursuit of different interrelationships.13 Since nearly any value activity can potentially be shared, a competitor may be able to forge an interrelationship among a different group of business units or share different value activities among the same group of businesses. If a firm, through pursuing an interrelationship, causes a competitor to respond by pursuing different interrelationships, it faces the danger that the ultimate outcome will be an erosion in its relative position.

A final consideration in assessing the difficulty of matching an interrelationship is whether the same benefits can be achieved by a competitor through a coalition or long-term contract. Sometimes a firm can gain the benefits of sharing through a joint venture or other form of coalition with another firm, without actually entering another industry. While such coalitions may be difficult to forge, they should always be considered in assessing the value of an interrelationship and how to achieve it.

4. Identifying Tangible Interrelationships

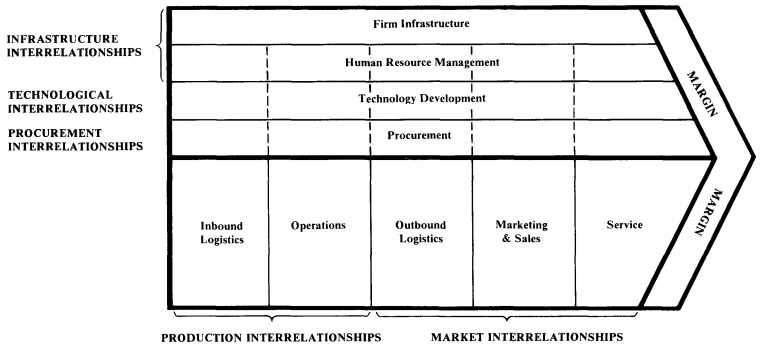

To aid in identifying the tangible interrelationships present in a firm, a useful starting point is to catalog all the forms of sharing that occur in practice as well as the alternative ways they can create competitive advantage. Figure 9-3 divides forms of sharing into five categories: production, market, procurement, technology, and infrastructure. I have included shared human resource management as part of shared infrastructure. It is useful to separate these categories of interrelationships because they raise different issues in sharing. Interrelationships ultimately stem from commonalities of various types among industries, such as common buyers, channels, or production processes. These commonalities define potential interrelationships; whether the interrelationships lead to a competitive advantage is a function of the benefits and costs described earlier. The sources of each category of interrelationship and the possible forms of sharing to capture it are shown in Table 9-1.

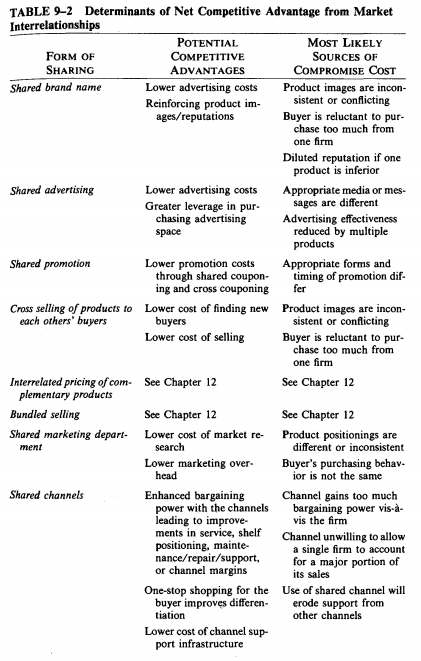

MARKET INTERRELATIONSHIPS

Market interrelationships involve the sharing of primary value activities involved in reaching and interacting with the buyer, from outbound logistics to service. When business units have only the geographic location of their buyers in common, sharing is usually restricted to physical distribution systems, order processing, and to servicing and sales if the products have similar sales and servicing needs. Richer opportunities for sharing are present when business units also have common buyers, common channels, or both. If buyers or channels are the same, sharing of physical distribution or order processing systems among business units usually involves less complexity and lower costs of sharing. In addition, common buyers or channels open up a wide variety of other possible forms of sharing shown in Table 9-1.

The subtleties in identifying potential market interrelationships stem from the tendency to view the buyer or channel too broadly. A wide variety of products and services are sold to oil companies, for example, including drilling equipment, refinery equipment, and transportation equipment such as oil tankers and tanker trucks. Thus oil companies might be identified as a common buyer by business units in many industries. The various products are sold to different parts of the oil company, however, which often have little contact with each other. Even within a product category such as drilling equipment, equipment used in exploration is frequently sold to a different organizational unit than production equipment. Even in instances when the same unit of the oil company makes the purchase, the particular individuals making the purchase decision or influencing the decision maker will often differ for different pieces of equipment. Engineers may be responsible for choosing some high-technology equipment such as blowout preventers, for example, while purchasing agents often choose more standard items such as pipe.

Figure 9-3. Categories of Tangible Interrelationships

Another example of viewing the buyer too broadly is becoming apparent from recent experience in financial services. The traditional buyer of stocks and bonds is a different individual than the average life insurance buyer. Both are different individuals than the typical buyer of futures. These differences are nullifying simplistic efforts to achieve market interrelationships in financial services. Meaningful opportunities for exploring market interrelationships among business units are usually present only where the decision makers for the products are the same or have some contact with each other.

The same issues arise in identifying common channels. Though two products might both be sold through department stores, few actual channel interrelationships are likely to be present if one is sold through discount department stores and the other through exclusive department stores such as Lord & Taylor and Neiman-Marcus. There are also often different buying executives responsible for different classes of products in the same channel. In most supermarket chains, for example, frozen foods are typically bought by a different buyer than meats, even though some frozen foods are meat products. Even if the decision makers are different, however, opportunities for sharing logistical and order processing systems may exist with both common buyers and common channels.

Whether products sold to a common buyer are substitutes or complements can also affect the advantage of sharing market-related activities. Shared marketing can yield less of a cost advantage when products are substitutes because the buyer will purchase either one product or the other but not both. However, offering substitute products to buyers can reduce the risk of substitution because losses in one product can be compensated in the other (see Chapter 8). Joint marketing of substitutes can also enhance a firm’s differentiation.

When business units sell complementary products to common buyers, the advantage of sharing is often greater than if the products are unrelated or substitutes. Complementary products usually have correlated demand that facilitates the efficient utilization of shared value activities, and other practices such as common branding, joint advertising and bundling. The strategic issues raised by complementary products, a subset of market interrelationships, are treated separately in Chapter 12.

The potential competitive advantages of the important forms of market interrelationships and the most likely sources of compromise cost are shown in Table 9-2. Indirect activities such as market research, sales force administration and advertising production (e.g., artwork, layout) can often be shared more easily than direct activities because they require lower compromise costs.75 The benefits of market interrelationships can often be enhanced by changes in the strategies of the involved business units that reduce the cost of compromise. Standardizing sales force practices, repositioning brands to make their images more compatible, or standardizing delivery standards or payment terms may make sharing easier, for example.

PRODUCTION INTERRELATIONSHIPS

Interrelationships in production involve the sharing of upstream value activities such as inbound logistics, component fabrication, assembly, testing, and indirect functions such as maintenance and site infrastructure. All these forms of sharing require that activities be located together. Doing so can lead to a compromise cost if the suppliers or buyers of the business units sharing the activities have greatly different geographic locations since inbound or outbound freight costs may be increased. Shared procurement is different from production interrelationships because merging facilities is not implied. Purchased inputs can be procured centrally but shipped from suppliers to dispersed facilities.

Production interrelationships can be illusory when apparently similar value activities are examined closely. For example, though the machines themselves are generically the same, a job-shop manufacturing process for one product may involve different machine tolerances than another, or lot sizes or run lengths can be quite different. As with market interrelationships, indirect value activities offer particularly attractive opportunities for sharing because the compromise costs are often low. For example, such activities as building operations, maintenance, site infrastructure, and testing laboratories can be shared despite the fact that the actual manufacturing processes are different.

Table 9-3 shows the potential competitive advantages of important forms of production interrelationships, and the likely sources of compromise cost. The balance will depend on the strategies of the involved business units. For example, two business units with differentiation strategies are more likely to have similar needs in terms of component specifications, manufacturing tolerances, and testing standards than if one business unit pursues cost leadership while another offers a premium product.

PROCUREMENT INTERRELATIONSHIPS

Procurement interrelationships involve the shared procurement of common purchased inputs. Common inputs are frequently present in diversified firms, particularly if one looks beyond major raw materials and pieces of capital equipment. Suppliers are increasingly willing to make deals based on supplying the needs of plants located around the world, and negotiate prices reflecting total corporate needs. Some firms go overboard in shared procurements, however, because they fail to recognize the potential costs of compromise or they establish a rigid procurement process that does not allow for opportunism in negotiating attractive opportunities.

The potential competitive advantage of shared procurement and the likely sources of compromise cost are shown in Table 9-4:

TECHNOLOGICAL INTERRELATIONSHIPS

Technological interrelationships involve the sharing of technology development activities throughout the value chain. They are distinguished from production interrelationships because their impact is on the cost or uniqueness of technology development, while production interrelationships involve sharing activities involved in the actual production of the product on an ongoing basis. It is important to recognize, however, that interrelationships in process development often occur together with production or market interrelationships. Interrelationships in process technology typically grow out of interrelationships in the primary activities.

As with other forms of interrelationships, apparently promising technological interrelationships can be illusory. Scientific disciplines that overlap for two business units may be of minor importance to success compared to scientific disciplines that do not overlap. Harris Corporation, for example, thought it could reduce the development expense involved in entering word processing through adapting software from its text editing system sold to newspapers. Harris discovered that the text editing system had so many features that were specific to the needs of newspapers that development of a word processing system had to start from scratch.

Truly significant technological interrelationships are ones involv-ing technologies important to the cost or differentiation of the products or processes involved, as microelectronics technology is to both tele- communications and data processing. Many products have superficial technological similarities, making the identification of true technological interrelationships difficult. As with other types of interrelationships, the net competitive advantage of a technological interrelationship will differ depending on the industry and strategies of the business units involved. For example, the benefits of sharing microelectronics technology will tend to be greater for two consumer products business units than for a defense business unit and a consumer business unit. Rockwell International learned this lesson when it put a team of engineers from its defense business into its Admiral TV set division. The sensitivity to cost was so much greater in TV sets than in defense equipment that sharing did not succeed. The same thing occurred in business aircraft, where a design developed originally for military use (the Sabreliner) proved too expensive for the commercial market.

Table 9-5 shows the potential competitive advantages that can stem from sharing technology development as well as the most likely sources of compromise costs.

INFRASTRUCTURE INTERRELATIONSHIPS

The final category of interrelationships involve firm infrastructure, including such activities as financing, legal, accounting, and human resource management. Some infrastructure activities are almost always shared in diversified firms, as described in Chapter 2. In most cases, the effect of sharing on competitive advantage is not great because infrastructure is not a large proportion of cost and sharing has little impact on differentiation. It is ironic, therefore, that the vast majority of literature on sharing has been on sharing infrastructure—principally finance and the utilization of capital. Interrelationships in finance, particularly, have been seen as a significant benefit the diversified firm contributes to its business units.

There are two basic sources of financial interrelationships: joint raising of capital and shared utilization of capital (primarily working capital). Economies of scale in raising capital may indeed exist, especially up to a certain quantity of capital needed. Efficient utilization of working capital is made possible by countercyclical or counterseasonal needs for funds among business units, which allows cash freed up by one business unit to be deployed in another. Financial interrelationships typically involve relatively few compromise costs that must be offset against any savings. Moreover, financial interrelationships are among the easiest to achieve if they are present, perhaps a reason why they are so frequently discussed.

The major limitation to the competitive advantage of shared financing is the efficiency of capital markets. Scale economies in financing appear to be moderate for most firms and lead to a relatively small difference in financing costs. Firms can also borrow to cover short-term cash needs and lend excess cash in the highly efficient markets for commercial paper and other instruments, mitigating the value of sharing working capital. Hence financial interrelationships are rarely the basis for creating a significant competitive advantage, unless the size and credit rating of competitors differ greatly. Other forms of infrastructure interrelationships can be important in particular industries. Shared infrastructure for hiring and training is important in some service industries, while shared government relations can be significant in natural resource firms.

Source: Porter Michael E. (1998), Competitive Advantage: Creating and Sustaining Superior Performance, Free Press; Illustrated edition.