1. The Transformation

The most significant organizational innovation of the twentieth century was the development in the 1920s of the multidivisional structure. That development was little noted and not widely appreciated, however, as late as 1960. Leading management texts extolled the virtues of “basic departmentation” and “line and staff authority relationships,” but the special importance of multidivisionalization,went unremarked.

Chandler’s pathbreaking study of business history, Strategy and Structure, simply bypassed this management literature. He advanced the thesis that “changing developments in business organization presented a challenging area for comparative analysis” and observed that “the study of [organizational] innovation seemed to furnish the proper focus for such an investigation” (Chandler, 1962 [1966 edition], p. 2). Having identified the multidivisional structure as one of the most important such innovations, he proceeded to trace its origins, identify the factors that gave rise to its appearance, and describe the subsequent diffusion of that organization form. It was uninformed and untenable to argue that organization form was of no account after the appearance of Chandler’s book.

The leading figures in the creation of the multidivisional (or M-form) structure were Pierre S. du Pont and Alfred P. Sloan; the period was the early 1930s; the firms were du Pont and General Motors; and the organizational strain of trying to cope with economic adversity under the old structure was the occasion to innovate in both. The structures of the two companies, however, were different.

Du Pont was operating under the centralized, functionally departmen- talized or unitary (U-form) structure. General Motors, by contrast, had been operated more like a holding company (H-form) by William Durant, whose genius in perceiving market opportunities in the automobile industry (Live- say, 1979, pp. 232-34) evidently did not extend to organization. John Lee Pratt, who served as an assistant to Durant and as chairman of the Appropriations Committee after Du Pont took an equity position in General Motors, observed that “under Mr. Durant’s regime we were never able to get things under control” (Chandler, 1966, p. 154). A leading reason is that the Executive Committee, which consisted of Division Managers, was highly politicized: “When one of them had a project, why he would vote for his fellow members; if they would vote for his project, he would vote for theirs. It was a sort of horse trading” (Pratt, quoted by Chandler, 1966, p. 154).

Chandler summarizes the defects of the large U-form enterprise in the following way:

The inherent weakness in the centralized, functionally departmentalized operating company . . . became critical only when the administrative load on the senior executives increased to such an extent that they were unable to handle their entrepreneurial responsibilities efficiently. This situation arose when the operations of the enterprise became too complex and the problems of coordination, appraisal, and policy formulation too intricate for a small number of top officers to handle both long-run, entrepreneurial, and short-run operational administrative activities. [ 1966, pp. 382-83]

The ability of the management to handle the volume and complexity of the demands placed upon it became strained and even collapsed. Unable meaningfully to identify with or contribute to the realization of global goals, managers in each of the functional parts attended to what they perceived to be operational subgoals instead (Chandler, 1966, p. 156). In the language of transaction cost economics, bounds on rationality were reached as tfie U-form structure labored under a communication overload while the pursuit of subgoals by the functional parts (sales, engineering, production) was partly a manifestation of opportunism.

The M-form structure fashioned by du Pont and Sloan involved the creation of semiautonomous operating divisions (mainly profit centers) organized along product, brand, or geographic lines. The operating affairs of each were managed separately. More than a change in decomposition rules was needed, however, for the M-form to be fully effective. Du Pont and Sloan also created a general office “consisting of a number of powerful general executives and large advisory and financial staffs” (Chandler, 1977, p. 460) to monitor divisional performance, allocate resources among divisions, and engage in strategic planning. The reasons for the success of the M-form innovation are summarized by Chandler:

The basic reason for its success was simply that it clearly removed the executives responsible for the destiny of the entire enterprise from the more routine operational activities, and so gave them the time, information, and even psychological commitment for long-term planning and appraisal. . .

[The] new structure left the broad strategic decisions as to the allocation of existing resources and the acquisition of new ones in the hands of a top team of generalists. Relieved of operating duties and tactical decisions, a general executive was less likely to reflect the position of just one part of the whole [ 1966 DD 382-83]’

In contrast with the holding company—which is also a divisionalized form but has little general office capability and hence is little more than a corporate shell— the M-form organization adds (1) a strategic planning and resource allocation capability and (2)monitoring and control apparatus. As a consequence, cash flows are reallocated among divisions to favor high-yield uses, and internal incentive and control instruments are exercised in a discriminating way. In short, the M- form corporation take many of the properties of (and is usefully regarded as) a miniature capital market,5 which is a much more ambitious concept of the corporation than the term “holding company” contemplates.

2. An Information Professing Interpretation

Most recent treatments of the corporation nevertheless accord scan, attention to the architecture of the firm and focus entirely on incentive features instead. In fact, however, organization form matters even in a firm in which incentive problems attributable to opportunism are missing. The studies of hierarchy by W.Ross Ashby (1960) and by Herbert Simon (1962) are germane.

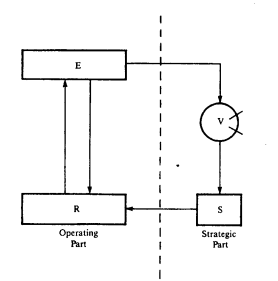

Ashby established that all adaptive systems that have a capacity to respond to a bimodal distribution of disturbances—some being disturbances in degree; other being disturbances in kind—will be characterized by double feedback. The rudimentary model is shown in Figure 11-1. Disturbances in degree are handled in the primary feedback loop (or operating part) within the context of extant decision rules. Disturbances in kind involve longer-run adjustments in which parameter changes are introduced or new rules are developed in the secondary (or strategic) feedback loop. The second feedback loop is needed because the repertoire of the primary loop is limited—which is a concession to bounded rationality. Evolutionary systems that are subject to such bimodal disturbances will, under natural selection, necessarily develop two readily distinguishable feedbacks (Ashby, 1960, p. 131).

Simon’s discussion of the organizational division of decision-making labor in the firm is in the same spirit. From “the information processing point of view, division of labor means factoring the total system of decisions that need to be made into relatively independent subsystems, each one of which can be designed with only minimal concern for its interaction with the others” (Simon, 1973, p. 270). That applies to both technical and temporal aspects of the organization. In both respects the object is to recognize and give effect to conditions of near decomposability. That is accomplished by grouping the operating parts into separable entities within which interactions are strong and between which they are weak and by making temporal distinctions of a strategic versus operating kind. Problems are thus factored in such a way that the higher- frequency (or short-run) dynamics are associated with the operating parts while the lower-frequency (or long-run) dynamics are associated with the strategic system (Simon, 1962, p. 477). Those operating and strategic distinctions correspond with the lower and higher levels in the organizational hierarchy, respectively. They furthermore correspond with the primary and secondary feedback loops to which Ashby referred.

FIGURE 11-1. Double Feedback

3. Governance

Effective divisionalization requires more than mere decomposition. Otherwise the H-form would have been an adequate answer to the strains that appear as the (indecomposable) U-form structure was scaled up.

Indeed, in a team theory world in which managers are assumed to share identical preferences, the problem of organization is precisely one of decom- posing the enterprise in efficient information processing respects (Marshak and Radner, 1972; Geanakoplos and Milgrom, 1984). As noted in Chapter 2, team theory combines the assumption of bounded rationality with non-self- interest- seeking. If, however, the managers of the firm are given to opportunism, additional problems of incentive alignment, decision review, audit-ing, dispute resolution, and the like must be confronted. Those who invented the M-form structure were aware of those needs and made provision for them.

Opportunism in the H-form enterprise can take several forms. For one thing, subsidiaries that have preemptive claims against their own earnings are unlikely to return those resources to the cento but will ” reinvest” to excess instead. Additionally, since the secondary feedback loop has limited compe-tence to evaluate performance, costs are apt to escalate. If subsidiaries enjoy relief from market tests because of corporate cross-subsidization, moreover, further cost excesses will appear. Finally, partisan decision-making of the kind that Pratt associated with General Motors in the Durant era may appear.

The M-form structure removes the general office executives from par-tisan involvement in the fuctional parts and assigns operating responsibilities to the divisions. The general office, moreover, is supported by an elite staff that has the capacity to evaluate divisional perfofmance. Not only, therefore, is the goal structure altered in favor of enterprise-wide considerations, but an improved information base permits rewards and penalties to be assigned to divisions on a more discriminating basis, and resources can be reallocated within the firm from less to more productive uses. A concept of the firm as an internal capital market thus emerges.

Effective multidivisionalization thus involves the general office in the following set of activities: (1) the identification of separable economic activities within the firm; (2) according quasi-autonomous standing (usually of a profit center nature) to each; (3) monitoring the efficiency performance of each division; (4) awarding incentives; (5) allocating cash flows to high-yield uses; and (6) performing strategic planning (diversification, acquisition, divestiture, and related activities) in other respects. The M-form structure is thus one that combines the divisionalization concept with an internal control and strategic decision-making capability.

4. An Isomorphism

Although the economic correspondences are imperfect, it is nevertheless of interest that the U-form, H-form, and M-form structures bear a formal relation to the basic contracting schema set out in Chapter 1. Figure 11-2 displays the parallel relations.

Thus whereas the contracting schema was developed in terms of two production technologies (k = 0 and k > 0), the organizational distinction to be made is between two information processing technologies (centralized and decentralized, respectively). Given the requisite preconditions102 and assuming the absence of opportunism, the k > 0/decentralized technologies will yield a superior result. But the k > 0/decentralized technologies also pose serious hazards of opportunism. Unless safeguards can be devised, the full benefits of the k > 0/decentralized technologies will go unrealized.

The s = 0 condition reflects a refusal to safeguard a contract for which nonredeployable assets are at hazard. The organizational correspondence is the H-form firm. The s > 0 conditions reflects a decision to provide protective governance. The M-form firm is the organizational counterpart for contractual safeguards. Thus the full benefits of the k > 0/decentralized organization are achieved only if s > 0/M-form governance is provided.

Indeed, the contracting analogy can be carried further by regarding in- vestors who supply capital to a firmas the counterpart of the suppliers of intermediate product in the nonstandard contracting context. Recall that suppliers of intermediate product were willing to employ any technology and would accept any contract for which expecte breakeven could be projected. The same is true of suppliers of capital: They will invest in any firm with any organization form on terms such that a competitive (risk-adjusted) rate of return can be projected. This, however, merely reflects the outcome of a competitive market process. More germane to our purposes here is the following. Although firms that employ an inferior (U-form) information technology or that do not safeguard the superior technology against the hazards of opportunism (H-form) may still be able to raise capital if their product line is sufficiently strong (e.g. they enjoy patent protection), they could raise capital on better terms if a superior information technology supported by safeguards were to be employed—which is what the M-form structure adds to decentralization.

Source: Williamson Oliver E. (1998), The Economic Institutions of Capitalism, Free Press; Illustrated edition.