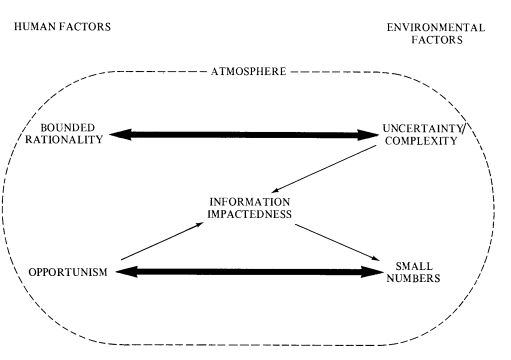

At the risk of oversimplification, the argument of the preceding sections of this chapter can be summarized by the schematic in Figure 3. The main pairings are shown by the heavy double-headed arrows which associate bounded rationality with uncertainty/complexity on the one hand and op- portunism with a small-numbers exchange relations on the other. Information impactedness is a derived condition, mainly due to uncertainty and opportunism, which in turn can give rise to a small-numbers result. That exchange takes place within a trading atmosphere is denoted by the broken line that surrounds the human and environmental factors which appear in the organizational failures framework.

To recapitulate, the advantages of internal organization20 in relation to markets are:

- In circumstances where complex, contingent claims contracts are infeasible and sequential spot markets are hazardous, internal organization facilitates adaptive, sequential decision making, thereby to economize on bounded rationality.

- Faced with present or prospective small-numbers exchange relations, internal organization serves to attenuate opportunism.

- Convergent expectations are promoted, which reduces uncertainty.

- Conditions of information impactedness are more easily overcome and, when they appear, are less likely to give rise to strategic behavior.

- A more satisfying trading atmosphere sometimes obtains.

The shift of a transaction or related set of transactions from market to hierarchy is not all gain, however. Flexibility may be sacrificed in the process and other bureaucratic disabilities may arise as well. The failures of internal organization, in relation to markets, are examined in Chapter 7.

Figure 3. The Organizational Failures Framework

Source: Williamson Oliver E. (1975), Markets and hierarchies: Analysis and antitrust implications, A Study in the Economics of Internal Organization, The Free Press.