First observed by the English economist Sir William Petty (1623-1687), trade cycle is defined as the existence of fluctuations in national income over a variable timespan. Government policy is used to dampen the magnitude of the fluctuations in order to maintain stability in the economy.

Petty’s findings were later developed by English economists THOMAS MALTHUS (1766-1834) and John Stuart Mill (1806-1873), the German political economist Karl Marx (1818-1883) and the Norwegian economist RAGNAR FRISCH (1895-1973).

There are several explanations for these cycles:

(1) In the 1940s and 1950s, Paul Samuelson, John Hicks, Richard Goodwin, WILLIAM PHILLIPS and Michal Kalecki combined the multiplier with the accelerator theory of investment (multiplier-accelerator).

(2) Milton Friedman asserts that business cycles are a monetary phenomenon.

(3) They may be the effect of changes in technology and taste changes.

(4) Ragnar Frisch found that a dynamic system with certain mathematic properties produced a ‘damped’ cycle with wavelengths of four to eight years.

Also see: business cycle, Kondratieff cycles, sunspot theory, product life-cycle theory, multiplier-accelerator, fine-tuning, political business cycle

Source:

RCO Matthews, The Trade Cycle (Cambridge, 1959);

R F Harrod, The Trade Cycle (Oxford, 1936);

E D Domar, ‘Capital Expansion, Rate of Growth, and Unemployment’, Econometrica, vol. XIV (April, 1946), 137-47

History

Theory

The first systematic exposition of economic crises, in opposition to the existing theory of economic equilibrium, was the 1819 Nouveaux Principes d’économie politique by Jean Charles Léonard de Sismondi.[4] Prior to that point classical economics had either denied the existence of business cycles,[5] blamed them on external factors, notably war,[6] or only studied the long term. Sismondi found vindication in the Panic of 1825, which was the first unarguably international economic crisis, occurring in peacetime.[citation needed]

Sismondi and his contemporary Robert Owen, who expressed similar but less systematic thoughts in 1817 Report to the Committee of the Association for the Relief of the Manufacturing Poor, both identified the cause of economic cycles as overproduction and underconsumption, caused in particular by wealth inequality. They advocated government intervention and socialism, respectively, as the solution. This work did not generate interest among classical economists, though underconsumption theory developed as a heterodox branch in economics until being systematized in Keynesian economics in the 1930s.

Sismondi’s theory of periodic crises was developed into a theory of alternating cycles by Charles Dunoyer,[7] and similar theories, showing signs of influence by Sismondi, were developed by Johann Karl Rodbertus. Periodic crises in capitalism formed the basis of the theory of Karl Marx, who further claimed that these crises were increasing in severity and, on the basis of which, he predicted a communist revolution. Though only passing references in Das Kapital (1867) refer to crises, they were extensively discussed in Marx’s posthumously published books, particularly in Theories of Surplus Value. In Progress and Poverty (1879), Henry George focused on land’s role in crises – particularly land speculation – and proposed a single tax on land as a solution.

Classification by periods

Business cycle with it specific forces in four stages according to Malcolm C. Rorty, 1922

In 1860 French economist Clément Juglar first identified economic cycles 7 to 11 years long, although he cautiously did not claim any rigid regularity.[8] Later[when?], economist Joseph Schumpeter argued that a Juglar cycle has four stages:

- Expansion (increase in production and prices, low interest rates)

- Crisis (stock exchanges crash and multiple bankruptcies of firms occur)

- Recession (drops in prices and in output, high interest-rates)

- Recovery (stocks recover because of the fall in prices and incomes)

Schumpeter’s Juglar model associates recovery and prosperity with increases in productivity, consumer confidence, aggregate demand, and prices.

In the 20th century, Schumpeter and others proposed a typology of business cycles according to their periodicity, so that a number of particular cycles were named after their discoverers or proposers:[9]

Proposed economic waves |

|

|---|---|

| Cycle/wave name | Period (years) |

| Kitchin cycle (inventory, e.g. pork cycle) | 3–5 |

| Juglar cycle (fixed investment) | 7–11 |

| Kuznets swing (infrastructural investment) | 15–25 |

| Kondratiev wave (technological basis) | 45–60 |

- The Kitchin inventory cycle of 3 to 5 years (after Joseph Kitchin)[10]

- The Juglar fixed-investment cycle of 7 to 11 years (often identified[by whom?] as “the” business cycle

- The Kuznets infrastructural investment cycle of 15 to 25 years (after Simon Kuznets – also called “building cycle”)

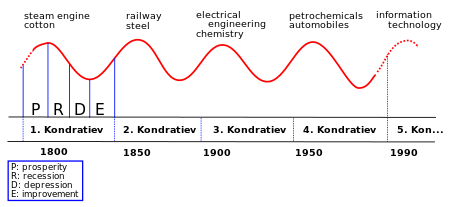

- The Kondratiev wave or long technological cycle of 45 to 60 years (after the Soviet economist Nikolai Kondratiev)[11]

Some say interest in the different typologies of cycles has waned since the development of modern macroeconomics, which gives little support to the idea of regular periodic cycles.[12]

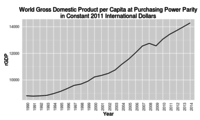

Others, such as Dmitry Orlov, argue that simple compound interest mandates the cycling of monetary systems. Since 1960, World GDP has increased by fifty-nine times, and these multiples have not even kept up with annual inflation over the same period. Social Contract (freedoms and absence of social problems) collapses may be observed in nations where incomes are not kept in balance with cost-of-living over the timeline of the monetary system cycle.

The Bible (760 BCE) and Hammurabi’s Code (1763 BCE) both explain economic remediations for cyclic sixty-year recurring great depressions, via fiftieth-year Jubilee (biblical) debt and wealth resets[citation needed]. Thirty major debt forgiveness events are recorded in history including the debt forgiveness given to most European nations in the 1930s to 1954.[13]

Occurrence

A simplified Kondratiev wave, with the theory that productivity enhancing innovations drive waves of economic growth

There were great increases in productivity, industrial production and real per capita product throughout the period from 1870 to 1890 that included the Long Depression and two other recessions.[14][15] There were also significant increases in productivity in the years leading up to the Great Depression. Both the Long and Great Depressions were characterized by overcapacity and market saturation.[16][17]

Over the period since the Industrial Revolution, technological progress has had a much larger effect on the economy than any fluctuations in credit or debt, the primary exception being the Great Depression, which caused a multi-year steep economic decline. The effect of technological progress can be seen by the purchasing power of an average hour’s work, which has grown from $3 in 1900 to $22 in 1990, measured in 2010 dollars.[18] There were similar increases in real wages during the 19th century. (See: Productivity improving technologies (historical).) A table of innovations and long cycles can be seen at: Kondratiev wave § Modern modifications of Kondratiev theory.

There were frequent crises in Europe and America in the 19th and first half of the 20th century, specifically the period 1815–1939. This period started from the end of the Napoleonic wars in 1815, which was immediately followed by the Post-Napoleonic depression in the United Kingdom (1815–30), and culminated in the Great Depression of 1929–39, which led into World War II. See Financial crisis: 19th century for listing and details. The first of these crises not associated with a war was the Panic of 1825.[19]

Business cycles in OECD countries after World War II were generally more restrained than the earlier business cycles. This was particularly true during the Golden Age of Capitalism (1945/50–1970s), and the period 1945–2008 did not experience a global downturn until the Late-2000s recession.[20] Economic stabilization policy using fiscal policy and monetary policy appeared to have dampened the worst excesses of business cycles, and automatic stabilization due to the aspects of the government’s budget also helped mitigate the cycle even without conscious action by policy-makers.[21]

In this period, the economic cycle – at least the problem of depressions – was twice declared dead. The first declaration was in the late 1960s, when the Phillips curve was seen as being able to steer the economy. However, this was followed by stagflation in the 1970s, which discredited the theory. The second declaration was in the early 2000s, following the stability and growth in the 1980s and 1990s in what came to be known as The Great Moderation. Notably, in 2003, Robert Lucas, in his presidential address to the American Economic Association, declared that the “central problem of depression-prevention [has] been solved, for all practical purposes.”[22] Unfortunately, this was followed by the 2008–2012 global recession.

Various regions have experienced prolonged depressions, most dramatically the economic crisis in former Eastern Bloc countries following the end of the Soviet Union in 1991. For several of these countries the period 1989–2010 has been an ongoing depression, with real income still lower than in 1989.[23] This has been attributed not to a cyclical pattern, but to a mismanaged transition from command economies to market economies.

Identifying

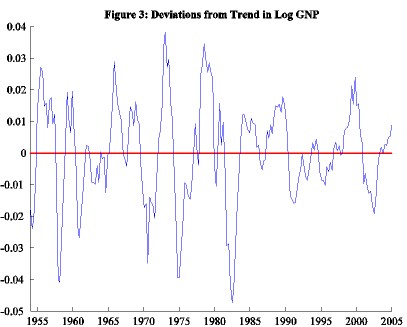

Economic activity in the United States, 1954–2005

Deviations from the long-term United States growth trend, 1954–2005

In 1946, economists Arthur F. Burns and Wesley C. Mitchell provided the now standard definition of business cycles in their book Measuring Business Cycles:[24]

Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; in duration, business cycles vary from more than one year to ten or twelve years; they are not divisible into shorter cycles of similar characteristics with amplitudes approximating their own.

According to A. F. Burns:[25]

Business cycles are not merely fluctuations in aggregate economic activity. The critical feature that distinguishes them from the commercial convulsions of earlier centuries or from the seasonal and other short term variations of our own age is that the fluctuations are widely diffused over the economy – its industry, its commercial dealings, and its tangles of finance. The economy of the western world is a system of closely interrelated parts. He who would understand business cycles must master the workings of an economic system organized largely in a network of free enterprises searching for profit. The problem of how business cycles come about is therefore inseparable from the problem of how a capitalist economy functions.

In the United States, it is generally accepted that the National Bureau of Economic Research (NBER) is the final arbiter of the dates of the peaks and troughs of the business cycle. An expansion is the period from a trough to a peak and a recession as the period from a peak to a trough. The NBER identifies a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production”.[26]

Upper turning points of business cycle, commodity prices and freight rates

There is often a close timing relationship between the upper turning points of the business cycle, commodity prices, and freight rates, which is shown to be particularly tight in the grand peak years of 1873, 1889, 1900 and 1912.[27]

Indicators

Numerous metrics are proposed to identify the business cycle, such as unemployment, stock market returns, and household spending rate. Series used to infer the underlying business cycle fall into three categories: lagging, coincident, and leading. Most are results of the cycle instead of the reason for the cycle, and thus lag. Economists and investors alike speculate which series may lead the business cycle, providing advanced warning of changes and an advantage in information.

A prominent coincident, or real-time, business cycle indicator is the Aruoba-Diebold-Scotti Index.

Spectral analysis of business cycles

Recent research employing spectral analysis has confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance.[28] Korotayev & Tsirel also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third sub-harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.[jargon]

Recurrence quantification analysis

Recurrence quantification analysis has been employed to detect the characteristic of business cycles and economic development. To this end, Orlando et al.[29] developed the so-called recurrence quantification correlation index to test correlations of RQA on a sample signal and then investigated the application to business time series. The said index has been proven to detect hidden changes in time series. Further, Orlando et al.,[30] over an extensive dataset, shown that recurrence quantification analysis may help in anticipating transitions from laminar (i.e. regular) to turbulent (i.e. chaotic) phases such as USA GDP in 1949, 1953, etc. Last but not least, it has been demonstrated that recurrence quantification analysis can detect differences between macroeconomic variables and highlight hidden features of economic dynamics.[31]

Cycles or fluctuations?

The Business Cycle follows changes in stock prices which are mostly caused by external factors such as socioeconomic conditions, inflation, exchange rates. Intellectual capital does not affect a company stock’s current earnings. Intellectual capital contributes to a stock’s return growth.[32]

In recent years economic theory has moved towards the study of economic fluctuation rather than a “business cycle”[33] – though some economists use the phrase ‘business cycle’ as a convenient shorthand. For example, Milton Friedman said that calling the business cycle a “cycle” is a misnomer, because of its non-cyclical nature. Friedman believed that for the most part, excluding very large supply shocks, business declines are more of a monetary phenomenon

It is the best time to make a few plans for the longer term and it is time to be happy. I have learn this put up and if I may I want to suggest you few fascinating things or advice. Maybe you can write subsequent articles referring to this article. I desire to learn more issues approximately it!

so much wonderful info on here, : D.