An industry scenario is an internally consistent view of an industry’s future structure. It is based on a set of plausible assumptions about the important uncertainties that might influence industry structure, carried through to the implications for creating and sustaining competitive advantage. An industry scenario is not a forecast but one possible future structure. A set of industry scenarios is carefully chosen to reflect the range of possible (and credible) future industry structures with important implications for competition. The entire set of scenarios, rather than the most likely one, is then used to design a competitive strategy. The time period used in industry scenarios should reflect the time horizon of the most important investment decisions.

An industry typically faces many uncertainties about the future. The important uncertainties are those that will influence industry structure, such as technological breakthroughs, entry of new competitors, and interest rate fluctuations. External factors such as macroeconomic conditions and government policy affect competition through, and not independently of, industry structure. Structural change almost always requires adjustments in strategy and creates the greatest opportunities for competitors to shift their relative positions.

The five competitive forces described in Chapter 1 constitute the conceptual foundation for constructing industry scenarios. Uncertain-ties that affect any of the five competitive forces will have implications for competition, and therefore must be considered in constructing scenarios. Constructing industry scenarios begins by analyzing current industry structure and identifying all the uncertainties that may affect it. These uncertainties are then translated into a set of different future industry structures. An overview of the process is shown in Figure 13-1.

The process shown in Figure 13-1 is deceptively simple. Constructing industry scenarios requires several iterations and is a judgmental process. It can be difficult to determine fully what uncertainties are the most important for strategy until a number of preliminary scenarios have been analyzed, hence the feedback loops on Figure 13-1.

The process shown in Figure 13-1 postpones the introduction of competitor behavior into each scenario until the industry structure and requirements for competitive advantage have been developed, despite the fact is often a source of uncertainty in its own right. However, predicting competitor behavior in a scenario poses a nearly impossible task without some understanding of the structural environment in which competitors will operate. Expected behavior of competitors under a scenario may serve to modify industry structure; uncertainty about competitor behavior may lead to additional scenarios.

I will use an extended example drawn from the U.S. chain saw industry in describing how to construct industry scenarios. It is necessary to provide some background on the U.S. chain saw industry so that the scenarios can be better understood. The chain saw industry had enjoyed a stable and profitable structure for decades prior to the 1970s. In the early 1970s, however, there were indications that the industry might be on the threshold of a major structural change. It was believed that sales of small chain saws to homeowners and other “casual users” might enter a period of explosive growth. If this happened, a major structural change in the industry would be triggered which could proceed in several directions.

In the early 1970s, the great majority of chain saws were sold to professional users including loggers, farmers, and others for whom chain saws were a primary tool of their trade. Professionals tended to use saws heavily and valued durability, comfort and reliability. They purchased saws primarily through chain saw dealers that also provided service and spare parts. Dealers tended to carry the product lines of relatively few manufacturers. Most chain saws were large, powerful gasoline saws assembled by manufacturers from a combination of purchased and manufactured parts. Suppliers of parts such as chains, bars, and sprockets were high-volume producers that enjoyed scale economies and some bargaining power. Electric saws were a potential substitute for gasoline saws, but were inadequate for most professional applications.

The major competitors in the early 1970s were Homelite (a division of Textron), McCulloch, and Stihl, followed by Roper, Remington and Beaird- Poulan. Industry rivalry was moderate, centering on quality, features, dealer network, and brand reputation. Homelite had the largest market share, followed by McCulloch. Both pursued differentiation strategies. Stihl competed by focusing on the premium-quality segment, and differentiated itself on quality, durability, and service.

By 1973, some major uncertainties loomed. The initial spurt in demand for chain saws by casual users had been brought on by the energy crisis, the do-it- yourself movement, and other causes. Casual users were much less sophisticated than professionals and used their saws less intensively for less demanding applications. Casual users also did not necessarily purchase saws from servicing dealers, and distribution channels for chain saws were broadening to include hardware chains, catalog showrooms and department stores, among others. This encouraged new entrants into the market. Black & Decker acquired McCulloch, and Beaird-Poulan was acquired by Emerson Electric. These acquisitions had created the potential for an injection of resources into competitors that had previously been financially constrained. In the remainder of this chapter, I will construct a set of industry scenarios for the chain saw industry while describing the principles that underlie scenario building.

1. Identifying Industry Uncertainties

Identifying uncertainties with the most important ramifications for competition lies at the heart of the industry scenario technique. Yet the sources of uncertainty can be hard to recognize and managers may find it difficult to detect discontinuous changes or shed their conventional wisdom. To identify uncertainties each element of industry structure must be examined and placed into one of three categories: constant, predetermined, and uncertain. Constant elements of industry structure are those aspects of structure that are very unlikely to change. Predetermined elements of structure are areas where structure will change, but the change is largely predictable. Predetermined trends may well proceed faster or slower depending on the scenario. Often a variety of structural changes are predetermined if a thoughtful industry analysis is done. Uncertain elements of structure are those aspects of future structure which depend on unresolvable uncertainties. Constant and predetermined structural variables are part of each scenario, while uncertain structural variables actually determine the different scenarios.

A way to begin determining which elements of industry structure fall into each category is to list all apparent industry trends and any possible major industry changes that have been discussed internally or mentioned by industry observers. While only those uncertainties that might affect structure will be important to scenario-building, it is important initially to identify all the uncertainties to avoid omitting important variables. Uncertainties with a low probability of occurrance but with a potentially large impact on structure must also not be overlooked. Each trend or possible change is then analyzed to deter- mine whether it could have a significant impact on industry structure, and how uncertain or predictable its impact is. Such a procedure will tend to produce a list of uncertainties that mixes causes and effects.

By considering only apparent trends, however, important discontinuities may be overlooked. Scenarios built only on apparent trends may reflect conventional wisdom and may not provide insights into future structure not available to competitors. One way to guard against overlooking discontinuities is to uncover observers of the industry who might foresee new possibilities. Soliciting opinions from outsiders new to the industry, who can view it objectively, provides another mechanism for overcoming conventional wisdom.

A wide range of environmental factors can lead to both predetermined and unpredictable industry changes, including technological trends, government policy shifts, social changes, and unstable economic conditions. Environmental changes are not important for their own sake, but because of their possible effect on industry structure. A number of underlying evolutionary processes, at work in every industry, are shown in Table 13-1.99 These provide a census of the forces that drive industry structural change. Each should be examined to see if and how it might affect the industry. Sometimes the evolutionary processes will proceed in predictable ways, while in other cases their speed and direction will be uncertain and lead to uncertainty about some elements of structure.

The possible industry changes that are most difficult to anticipate are frequently those that originate outside an industry. For example, many firms in industries that had little or no previous contact with electronics were taken by surprise by the development of microcomputers. New entrants also have less predictable and often more profound impacts on industry structure than do start- up competitors.

In some industries, therefore, scenarios are best constructed by starting inside the industry and looking outward for additional sources of uncertainty. In other industries, it is more appropriate to begin with macroscenarios and then narrow the focus to the industry. Macroscenarios can provide important insights into possible industry changes. They can expose possible shifts in macroeconomic, political, or social variables that are not foreseen in a more industry-centered view of the external environment. Another way of identifying uncertainties is broadly based technological forecasting. A systematic look at how any of the technologies in the firm’s value chain (Chapter 5) might be affected by outside developments can sometimes help to reveal changes unforeseen by technical personnel inside a firm.

In constructing scenarios, it is important to try to identify one or more major discontinuities that would have a significant impact on structure, such as a revolutionary technological change. If major discontinuities have a material probability of occurring, they should be treated as one of the important uncertainties in developing scenarios. If a major discontinuity will have a fundamental impact on structure but is very remote, it is usually best treated separately from the normal scenarios.

To illustrate the application of these ideas, Table 13-2 lists the uncertain elements of structure in the chain saw industry in 1973. Significant uncertainties existed in all of the five forces except for suppliers. Since each uncertain element of structure can serve as the basis for several scenarios and the list of uncertainties can be quite long, as it is in the chain saw industry, these sources of uncertainty must be distilled into the few scenarios that will be truly important to strategy.

2. Independent Versus Dependent Uncertainties

Converting the list of uncertain structural elements into scenarios begins by dividing them into independent and dependent uncertainties:

- Independent uncertainties. Those elements of structure whose uncertainty is independent of other elements of structure. The sources of the uncertainty may be inside the industry (e.g., competitor behavior) or outside the industry (e.g., oil prices).

- Dependent uncertainties. Those elements of structure that will be largely or completely determined by the independent In chain saws, for example, the future level of advertising on television is quite uncertain but will be primarily a function of the size of casual user demand. Casual users are receptive to television advertising while professional and farm buyers are best reached through specialized magazines.

Independent uncertainties are the scenario variables on which scenarios are based. Only independent uncertainties are an appropriate basis for constructing scenarios because they are true sources of uncertainty. Dependent uncertainties are resolved once assumptions about the independent uncertainties have been made, and thus become part of each scenario.

Independent and dependent uncertainties often differ only in degree, because many industry structural characteristics will be determined in part by independent uncertainties and partly influenced by other industry characteristics. Industry concentration, for example, is largely based on the height of entry barriers and hence dependent, but is also a function of independent factors such as an unexpected acquisition or entry by a strong competitor. Thus, as in all phases of scenario construction, one must attempt to assess the most significant factors influencing each uncertain variable and use them to classify it as either dependent or as a true scenario variable. It is often not apparent in the beginning of an analysis which uncertainties are dependent. Once scenarios are analyzed, it may be necessary to modify the way a particular element of structure is classified.

Separating uncertain elements of industry structure into those that are scenario variables and those that are dependent requires that the causal factors of uncertain elements of structure be identified. Causal factors determine the future state of each uncertain structural element. For example, the level of casual user demand in chain saws will be a function of such causal factors as energy prices, the rate of household formation, how many new houses are built with fireplaces, and so on.

Practical considerations may dictate not going all the way back to the most fundamental causal factors determining an uncertain variable since they may be numerous and hard to measure. However, causality must be traced back far enough to separate scenario variables from dependent variables. Causal factors also are important in determining the appropriate range of assumptions that should be made about each scenario variable. If the level of casual user demand is strongly influenced by energy prices, for example, then forecasting the range of possible energy prices is necessary to understand the range of feasible levels of demand.

Table 13-3 identifies the scenario variables in the chain saw industry from the full list of uncertainties that were shown in Table 13-2 and ranks them in terms of their importance to industry structure. The scenario variables in the chain saw industry are relatively few, because many of the uncertainties in the industry will be resolved once the demand for casual user saws and the channels through which they are sold become clear. Future safety regulations by government, for example, will probably be introduced if casual user demand grows and the number of accidents increases with the number of less sophisticated users. Marketing activity will also increase sharply and shift toward television advertising if casual user sales grow.

Table 13-4 shows the causal factors for the four important scenario variables in the chain saw industry. Several causal factors underlie each variable, as is typically the case. Causal factors reflect forces both within and external to the industry. It is also apparent from Table 13-4 that some of the causal factors reflect other aspects of industry structure or competitor behavior. Casual user demand, for example, is partly determined by the intensity of marketing activity and pricing behavior of competitors. The future mix of channels will in turn be influenced by the level of casual user demand, because casual users prefer different channels than professionals. It is not uncommon for scenario variables to have some internal causes along with external ones, and the analysis of scenarios must reflect such interdependencies.

The uncertainty that surrounds the causal factors of each scenario variable leads to scenarios. Assumptions about the scenario variables will determine the outcome of dependent uncertainties. Predetermined and constant elements of structure are then added to the scenario to complete the profile of the future structure of the industry, recognizing that the rate of change of predetermined trends may be different under each scenario. Figure 13-2 illustrates the process schematically.

Constructing a useful scenario involves developing a logic for how the various elements of industry structure interrelate, separating true scenario variables from dependent and predetermined industry changes. A scenario must seek to expose second-order effects of structural changes that result from one industry change affecting others. Such a logic for how various aspects of industry structure interrelate is at the heart of the usefulness of the scenario technique because it is usually important to understanding the implications of scenarios for strategy.

2. Identifying a Set of Scenarios

An industry scenario is based on a set of plausible assumptions about each of the scenario variables, derived from the causal factors. The consequences of this set of assumptions for industry structure flows from the process diagrammed in Figure 13-2. A scenario emerges as an internally consistent view of the future industry structure under one set of assumptions. The range of plausible assumptions about the potential outcomes of scenario variables determines the appropriate set of scenarios for analytical purposes.

Constructing a set of industry scenarios would be relatively simple once the scenario variables had been determined if there was only one scenario variable. If the only scenario variable in the chain saw industry was the level of casual user demand, for example, then a manageable number of scenarios could be constructed by making several plausible assumptions about demand. However, the number of relevant scenario variables is greater than one in most industries. The number of combinations generated by differing assumptions about each scenario variable can multiply rapidly, and with it the number of scenarios that might be analyzed. With four scenario variables in chain saws, for example, dozens of scenarios could easily be constructed.

Figure 13-2. Determinants of Future Industry Structure

There are two ways to limit the proliferation of scenarios—reducing the number of scenario variables and reducing the number of assumptions made about each one. The first step is to ensure that the scenario variables are all truly uncertain and independent. This test may lead to the elimination of some variables. Another way to reduce the number of scenario variables is to concentrate on only those with a significant potential impact on structure. While many factors will have some impact on future structure, fewer will have an impact significant enough to influence competitive strategy. Sometimes the impact of a variable on structure only becomes clear once the analysis of scenarios has begun. In the chain saw industry, however, all four scenario variables are important.

The next step in determining the set of scenarios to analyze is to specify the different assumptions to be made about each scenario variable. The appropriate range of assumptions will depend on the extent to which its causal factors could differ. Scenario variables can be discrete or continuous. When a scenario variable is discrete (e.g., a regulation is either signed into law or it is not), the choice of assumptions is relatively clear. When the scenario variable is continuous (e.g., the level of casual user demand), a question arises as to how to make the appropriate assumptions about its value.

The choice of assumptions should be governed by four factors: the need to bound the uncertainty, regularity of the impact on structure, managers’ beliefs, and practicality. Assumptions about a scenario variable should bound the feasible range of values that variable could take, exposing the important differences in possible industry structure. Since scenarios are not meant to be forecasts, it is important that those with a low probability of occurrence not be ignored. The use of extreme values can increase the understanding of the directions in which industry structure could evolve. Wide differences in the level of casual user demand, for example, will strongly influence the path of evolution in the chain saw industry. However, this does not mean that very unlikely values for a variable should be used in constructing scenarios unless these very unlikely outcomes would lead to industry structures that differ substantially from more likely outcomes. The credibility of scenarios can be damaged if they are based on highly implausible assumptions.

Having bounded the feasible range of uncertainty, the number of assumptions in between about each variable must be selected. If changes in the value of a scenario variable affect structure in a predictable way between its extremes, the number of assumptions can be small. If this is not the case, however, the range of assumptions must reflect major discontinuities. In chain saws, for example, a medium level of casual user demand is likely to have an impact on structure that is not simply between that of very low and very high demand. A medium level of demand provides room for only one or two new efficient-scale manufacturing facilities, and thus raises the possibility that several competitors will expand simultaneously, leading to overcapacity. An even more striking case of irregularity of impact is in the extent of sales through servicing dealers. It is possible that the percentage of saws sold through dealers will fall rapidly as casual user demand grows, but recover once first-time chain saw buyers trade up to larger saws and require service. This has quite different structural implications from scenarios featuring low or high dealer share.

A third consideration in choosing what assumptions to make about each scenario variable is the beliefs held by senior management. It is important to build at least one scenario around assumptions that reflect their commonly held beliefs. This lends credibility to the scenario building process. Scenarios reflecting managers’ assumptions can also be useful in exposing the differences in the assumptions of various senior managers, as well as in testing the overall consistency of assumptions that managers have made independently about each scenario variable. If the scenario that results from combining these assumptions is implausible, managers’ thinking about the future may be changed. All this is also important in demonstrating the validity of employing multiple scenarios rather than a single scenario.

A final consideration in choosing the number of assumptions about each scenario variable is the practical limit on the number of scenarios that can be meaningfully analyzed. A proliferation of scenarios beyond three or four may make analysis so onerous that the strategic issues are obscured. Thus compromises may well be necessary to reduce the number of assumptions examined. Since scenarios can be added, eliminated, or combined later in the analysis, it is important not to impose this constraint too strongly.

variables in the chain saw industry. Except for the level of casual user demand and mix of dealer versus nondealer sales, two assumptions about each variable are sufficient to expose the implications for industry structure. The key distinction in the shape of the penetration curve is whether it rises smoothly, or rises rapidly and then levels off (peaking). Peaking raises the risk of excessive capital investment by competitors. The extent of private label sales is important in determining the bargaining power of buyers and the relative position of well- known brands such as McCulloch and Homelite (manufacturers’ brands are clearly not as important in private label sales). Each assumption shown in Table 13-5 can be quantified.

3. Consistency of Assumptions

A scenario should be an internally consistent view of what future industry structure could be. Internal consistency is partly ensured by separating the scenario variables from the dependent ones. Another critical requirement, however, is the consistency of the assumptions made about each scenario variable with each other.

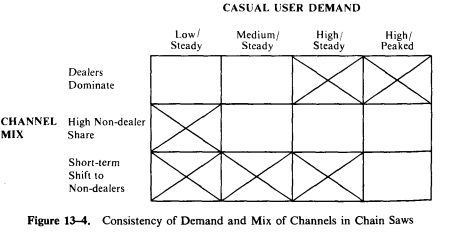

Often scenario variables affect one another, and thus some combinations of assumptions about them are not internally consistent. This can lead to the elimination of some scenarios. Figure 13-3 and 13-4 illustrate the process in the chain saw industry. Figure 13-3 compares the level of casual user demand and the shape of the casual user penetration curve. It is unlikely that the penetration curve will be peaked unless casual user demand is high. Hence, two combinations of assumptions (cells in Figure 13-3) are inconsistent. Figure 13-4 compares the four consistent combinations of assumptions about demand and the shape of the penetration curve against the mix of channels. Once again, some combinations of assumptions are not mutually consistent and can be eliminated. Servicing dealers will dominate only if casual user demand is not high. Nondealers will not gain a high share of sales unless casual demand is medium or high. A short-term shift to nondealers is likely only if demand for casual users is high and peaked, leading to an increase in nondealer share followed by a fall-off in casual demand and the migration of the more serious casual users to dealers. The fourth scenario variable, the percentage of saws sold under private label versus sold branded through nondealers, is not shown on Figure 13-4. However, high private label penetration is clearly inconsistent with domination by the dealer channel.

Thus we can reduce the number of consistent scenarios in the chain saw industry to the ten shown in Figure 13-5. These ten combinations of assumptions about the scenario variables are internally consistent and, therefore, are candidates for further analysis. The process of determining internally consistent assumptions is vitally important to constructing industry scenarios, because consistency in viewing the future is one of the principal benefits of the scenario technique.

4. Analyzing Scenarios

The next step in scenario planning is to analyze the implications of each scenario for competition. The analysis of a scenario involves the following:

- determining future industry structure under the scenario

- developing the implications of the scenario for industry structural attractiveness

- identifying the implications of the scenario for the sources of competitive advantage

To determine the implications of a scenario for future industry structure, the process diagrammed in Figure 13-2 is carried out. Assumptions about scenario variables determine the dependent elements of structure. These are combined with the predetermined and constant elements of structure to complete the scenario. Predetermined changes in structure may be speeded up or slowed down for different scenarios. Each scenario will provide a picture of the five forces representing the industry’s structure in the event that the assumptions about the scenario variables come true.

This future structure will be more or less attractive in terms of profitability. The industry structure under each scenario will determine, and possibly shift, the sources of competitive advantage. For example, a scenario characterized by low casual user demand will imply very different requirements for competitive advantage than a scenario where casual user demand is high and the mix of channels shifts away from servicing dealers. In the latter scenario, differentiation will be based more on advertising and having light, compact saw designs rather than on traditional sources of uniqueness such as excellent dealers and durable saws. The analysis of each industry scenario must specify the resulting implications for competitive advantage in the value chain.

Scenarios may differ in:

- the relative importance of value activities

- the appropriate configuration of the value chain

- the drivers of cost or uniqueness

- the importance of interrelationships

- the sustainability of different sources of competitive advantage

- the choice of generic strategies

Table 13-6 illustrates the analysis of two of the chain saw industry scenarios. Scenario 1 results in a structure quite similar to the current industry structure, while Scenario 7 results in a very different structure with quite different requirements for competitive advantage.

An important part of analyzing a scenario is determining when it will become clear that the particular scenario has come to pass.

Sometimes a scenario emerges quickly. In chain saws, however, a year passed before the uncertainty over the level of casual user demand was reduced. Several more years went by before the peaking of casual user demand was known. Competitors must choose between committing to a strategy early or waiting until better information becomes available. Therefore, a firm must estimate when uncertainties will be resolved in order to predict competitor behavior and to set the firm’s own strategy.

5. Introducing Competitor Behavior into Scenarios

If the firm has a dominant position in its industry or if competitor behavior has little potential effect on structure, the analysis of each scenario can stop at the industry level. In most industries, however, competitors can affect industry structure and their strategies will influence a firm’s options and likely success. Thus the analysis of scenarios must include competitors. In industries where a few powerful competitors exist, competitor analysis can be the most important part of analyzing each scenario.

The future industry structure under each scenario will usually have different consequences for different competitors. Increased casual user demand, for example, will greatly benefit firms with existing casual user models and representation in mass distribution channels compared to firms that exclusively serve professionals. Competitors will respond to structural change in ways that reflect their goals, assumptions, strategies, and capabilities. For example, Beaird-Poulan’s response to growing casual user demand is likely to be aggressive, conditioned by its parent company’s (Emerson Electric) aggressive growth goals. The behavior of competitors may, in turn, affect the speed and direction of structural changes in the scenario through a feedback loop. In chain saw Scenario 7, for example, aggressive investment in new capacity by Beaird- Poulan and McCulloch would enhance rivalry compared to the situation where one or both chose a conservative stance.

The full arsenal of competitor analysis tools should be brought to bear in predicting how competitors will behave under different scenarios. Strategic mapping is often a useful tool for integrating predictions of likely competitor’s responses under a scenario.100 The axes of the map are chosen to reflect the critical sources of sustainable competitive advantage implied by the scenario. Since each scenario implies a different future industry structure, the variables that will most influence the relative position of competitors may vary. For example, since industry structure under chain saw Scenario 7 will shift toward more price rivalry, manufacturing scale will become an important source of competitive advantage though it is not as important under Scenario 1.

Strategic mapping allows the simultaneous display of all competitors’ expected behavior under a scenario. It also facilitates the analysis of interactions among competitors and their responses to each others’ moves. If all competitors are forecast to move in one direction under a scenario, for example, some may modify their strategies as the scenario unfolds to avoid a head-on confrontation.

Often competitor behavior is difficult to predict. If the behavior of one or more important competitors under a scenario is both uncertain and likely to have an important impact on competition, this introduces an additional scenario variable into the scenario. Scenarios under which there are key uncertainties about competitors must then be split into two or more additional scenarios based on assumptions about how competitors’ behavior will differ. This same approach may be necessary to deal with uncertainty about the likelihood of potential new entrants with differing resources and skills from existing competitors.

Figure 13-6 illustrates the most important competitor uncertainties in the chain saw industry scenarios analyzed in Table 13-6. Under Scenario 1, the major uncertainty is whether McCulloch and Beaird- Poulan will aggressively invest in new capacity and advertising even though the casual user market never fully materializes. Both have strong proclivities to be aggressive given their new parent companies. Moreover, it will not be immediately clear to either firm which scenario is coming to pass. Under Scenario 7, Homelite’s strategy poses the key uncertainty because McCulloch and Poulan’s actions are quite predictable. Homelite may choose to pursue the entire casual user market despite the shift in strategy implied, or remain in its traditional segments and earn high profits at the expense of share. While Homelite’s parent company may be prone to demand high profits, the opportunity for rapid growth could also influence Homelite’s choice.

6. The Number of Scenarios To Analyze

Since the analysis of a scenario is often complex and time consuming, scenarios should be analyzed in a sequence that yields the necessary insight for the selection of a strategy without requiring full blown analysis of every possible scenario. A good starting point is to analyze the polar, or most widely separated, scenarios first. The polar scenarios typically lead to the most different industry structures and thus will help bound the range of strategic options. The stark contrast between polar scenarios is often very stimulating to strategic thinking. In the chain saw industry, Scenarios 1 and 7 were the polar scenarios on Figure 13-5.

The next scenario analyzed after the polar scenarios should be one where the structural outcome is expected to differ significantly from the polar scenarios. The scenario deemed most likely to occur should also be analyzed. This process should continue until the way in which the scenario variables determine future structure is understood. In addition, major discontinuities with a low probability of occurring should be included as special scenarios which are analyzed less extensively but factored into strategic choices.

Figure 13-7 shows the analysis of an intermediate chain saw scenario, Scenario 9. This is very different scenario from Scenarios 1 and 7, because it assumes that casual user saws are a fad and private label sales will never catch on. Thus Scenario 9 creates a dilemma for firms about how to capitalize on the short-lived casual user boom without alienating dealers or sacrificing key competitive strengths. It is clear from Figure 13-7 that the determinants of competitive advantage and likely competitor behavior will be quite different under Scenario 9 than under the other two scenarios. Briefer consideration of other chain saw scenarios suggests that these three industry scenarios are representative of the impact of uncertainty on competition.

The purpose of scenarios is to understand the different ways in which industry and competitive conditions might change. Forecasts are frequently not accurate, and scenarios attempt instead to illustrate the logical outcomes of a range of forecasts. The scenarios actually analyzed will be but a few of the almost infinite number of possible futures that might occur in an industry. However, well-chosen scenarios will illuminate the range of futures germane to strategy formulation. Scenarios should be chosen to communicate, educate, and stretch managers’ thinking about the future.

7. Attaching Probabilities to Scenarios

Rarely will each scenario be equally likely to occur. Industry scenarios are not intended to cover all possible outcomes—they are devices for exploring the strategic implications of possible future industry structures. However, the strategic implications of scenarios are partly a function of their likelihood of occurring. It is important to determine the relative probabilities of outcomes that are broadly similar to each scenario. If the scenarios analyzed are well chosen, they will represent the range of industry outcomes that might occur. In chain saws, outcomes close to Scenario 1 are the least likely to occur, while outcomes close to Scenarios 7 and 9 are about equally likely.

Attaching probabilities to scenarios is beset with problems of bias and conventional wisdom. It is important to find unbiased ways to assess the probabilities of scenarios, based on the underlying causal factors of each scenario variable. Managers’ own implicit probabilities should be identified and confronted if they vary widely or contradict those indicated by industry analysis.

8. Summary Characteristics of Industry Scenarios

A number of characteristics distinguish industry scenarios. Each scenario is, in effect, a full analysis of industry structure, competitor behavior, and the sources of competitive advantage under a particular set of assumptions about the future. The whole range of techniques available for analyzing industries and competitive advantage must be brought to bear; the scenario tool is merely a framework for identifying the key uncertainties and analyzing them, not an end in itself. The process of understanding how uncertainty affects future industry structure is as important as the scenarios that are actually constructed.

The successful analysis of industry scenarios hinges on judgment and compromise. Constructing scenarios is a process of abstracting those elements of uncertainty that will drive strategic choices. Selecting and analyzing a few scenarios from the range of future industry structures requires picking the most important cases and simplifying them. The process is nearly always iterative, because the analyst will better understand the relationship between the key uncertainties and industry structure as the analysis proceeds.

Finally, it should be clear that a major purpose of industry scenarios is to ensure internal consistency of a firm’s view of the future. A scenario aims to create a view of future industry structure that recognizes the interactions among variables and the need for consistency among assumptions about different industry characteristics. Scenarios provide a way of linking uncertain trends together into a number of alternate but consistent views of the future. Thus scenarios emphasize the ways in which industry trends and competitor behavior will interact or reinforce each other. Scenarios aim to reduce the chances that actions taken to deal with one element of uncertainty in an industry will unintentionally worsen a firm’s position vis-à-vis other uncertainties.

Source: Porter Michael E. (1998), Competitive Advantage: Creating and Sustaining Superior Performance, Free Press; Illustrated edition.