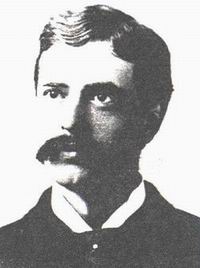

Irving Fisher was one of the earliest American neo-classicals of unusual mathematical sophistication. He made numerous important contributions to the Neo-classical Marginalist Revolution, of which the following are but a sample:

Irving Fisher was one of the earliest American neo-classicals of unusual mathematical sophistication. He made numerous important contributions to the Neo-classical Marginalist Revolution, of which the following are but a sample:

(1) his contributions to the Walrasian theory of equilibrium price (he also invented the indifference curve device) in 1892;

(2) his volumes on the theory of capital and investment (1896, 1898, 1906, 1907, 1930) which brought the Austrian intertemporal theories into the English-speaking world, wherein he introduced the famous distinction between “stocks” and flows”, the Fisher Separation Theorem and the loanable funds theory of interest rates.

(3) his famous resurrection of the quantity theory of money (1911, 1932, 1935);

(4) the theory of index numbers (1922);

(5) the Phillips Curve (1926)

(6) his debt-deflation theory (1933) which is echoed in Post Keynesian economics.

This Yale economist was an eccentric and colorful figure. When Irving Fisher wrote his 1892 dissertation, he constructed a remarkable machine equipped with pumps, wheels, levers and pipes in order to illustrate his price theory – see here for pictures of his draft and his first and second prototypes. Socially, he was an avid advocate of eugenics and health food diets. He made a fortune with his visible index card system – known today as the rolodex – and advocated the establishment of an 100% reserve requirement banking system His fortune was lost and his reputation was severely marred by the 1929 Wall Street Crash, when just days before the crash, he was reassuring investors that stock prices were not overinflated but, rather, had achieved a new, permanent plateau.

Major Works of Irving Fisher

– Mathematical Investigations in the Theory of Value and Prices, 1892

– Appreciation and Interest, 1896

– The Role of Capital in Economic Theory, 1897

– Precedents for Definining Capital, 1898

– The Nature of Capital and Income, 1906

– The Rate of Interest, 1907

– National Vitality, its wastes and conservation, 1910

– The Equation of Exchange, 1896-1910, 1911

– Recent Changes in Price Levels and Their Causes, 1911

– The Purchasing Power of Money: Its determination and relation to credit, interest and crises, 1911

– The Equation of Exchange, for 1911, and Forecast, 1912

– An International Commission on Cost of Living, 1912

– Will the Present Upward Trend of World Prices Continue?, 1912

– Elementary Principles of Economics, 1912

– A Remedy for the Rising Cost of Living: Standardizing the Dollar, 1913

– The Equation of Exchange’ for 1912, and Forecast, 1913

– The Impatience Theory of Interest, 1913

– Objections to a Compensated Dollar Answered, 1914

– Why is the Dollar Shrinking? A study in the high cost of living

– After the war, what? A plea for a league of peace, 1914

– Review of Auspitz and Lieben’s Theory of Price, 1915

– Some Contributions of the War to Our Knowledge of Money and Prices, 1918

– Is ‘Utility’ the Most Suitable Term for the Concept It is Used to Denote?, 1918

– Economists in Public Service, 1919

– Stabilizing the Dollar, 1919

– Consideration of the Proposal to Stabilize the Unit of Money: Rejoinder, 1919

– Stabilizing the Dollar, 1920

– The Making of Index Numbers: A study of their varieties, tests and reliability, 1922

– The Statistical Relation Between Unemployment and Price Changes, 1926

– Prohibition at its Worst, 1927

– The Money Illusion, 1928

– The Theory of Interest: As determined by the impatience to spend income and opportunity to invest it, 1930

– Booms and Depressions, 1932

– The Debt-Deflation Theory of Great Depressions, 1933

– Inflation, 1933

– Stamp Scrip, 1933

– 100% Money, 1935

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care