Term structure of interest rates refers to the relationship between the fixed amount of interest paid on a financial security (such as a government or corporate bond) and the amount of time before the bond reaches its maturity date.

Early work on this theory of expectations was carried out by US economist Irving Fisher (1867-1947) and English economist John Hicks (1904-1989).

Also see: adaptive expectations, random walk hypothesis, rational expectations theory, time preference theory of interest

Influencing factors

Interest rates vary according to:

- the government’s directives to the central bank to accomplish the government’s goals

- the currency of the principal sum lent or borrowed

- the term to maturity of the investment

- the perceived default probability of the borrower

- supply and demand in the market

- the amount of collateral

- special features like call provisions

- reserve requirements

- compensating balance

as well as other factors.

Example

A company borrows capital from a bank to buy assets for its business. In return, the bank charges the company interest. (The lender might also require rights over the new assets as collateral.)

A bank will use the capital deposited by individuals to make loans to their clients. In return, the bank should pay individuals who have deposited their capital interest. The amount of interest payment depends on the interest rate and the amount of capital they deposited.

Related terms

Base rate usually refers to the annualized rate offered on overnight deposits by the central bank or other monetary authority.[citation needed]

The Annual percentage rate (APR) may refer either to a nominal APR or an effective APR (EAPR). The difference between the two is that the EAPR accounts for fees and compounding, while the nominal APR does not.

The annual equivalent rate (AER), also called the effective annual rate, is used to help consumers compare products with different compounding frequencies on a common basis, but does not account for fees.

A discount rate is applied to calculate present value.

For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price. Yield to maturity is a bond’s expected internal rate of return, assuming it will be held to maturity, that is, the discount rate which equates all remaining cash flows to the investor (all remaining coupons and repayment of the par value at maturity) with the current market price.

Based on the banking business, there are deposit interest rate and loan interest rate.

Based on the relationship between supply and demand of market interest rate, there are fixed interest rate and floating interest rate.

Monetary policy

Interest rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country’s economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.[3][4][5][6][7]

History

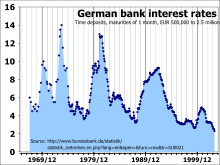

Germany experienced deposit interest rates from 14% in 1969 down to almost 2% in 2003

In the past two centuries, interest rates have been variously set either by national governments or central banks. For example, the Federal Reserve federal funds rate in the United States has varied between about 0.25% and 19% from 1954 to 2008, while the Bank of England base rate varied between 0.5% and 15% from 1989 to 2009,[8][9] and Germany experienced rates close to 90% in the 1920s down to about 2% in the 2000s.[10][11] During an attempt to tackle spiraling hyperinflation in 2007, the Central Bank of Zimbabwe increased interest rates for borrowing to 800%.[12]

The interest rates on prime credits in the late 1970s and early 1980s were far higher than had been recorded – higher than previous US peaks since 1800, than British peaks since 1700, or than Dutch peaks since 1600; “since modern capital markets came into existence, there have never been such high long-term rates” as in this period.[13]

Possibly before modern capital markets, there have been some accounts that savings deposits could achieve an annual return of at least 25% and up to as high as 50%. (William Ellis and Richard Dawes, “Lessons on the Phenomenon of Industrial Life… “, 1857, p III–IV)

Attractive section of content. I simply stumbled upon your weblog and in accession capital to say that I get in fact enjoyed account your weblog posts. Any way I’ll be subscribing in your augment or even I success you get entry to persistently quickly.