These developments provide support for managerial theories such as the theories that follow Williamson (1963) which assume that managers have their own objective of utility maximization, subject to a minimum profit constraint that will satisfy shareholders. In Williamson’s model this is the reported profit level (πR). If πR is acceptable to shareholders, then πR must be a normal profit. I review this model and propose an alternative interpretation here.

Williamson’s model shows that managerial utility maximization sub- ject to a minimum (reported) profit constraint (πR) may be consistent with long run profit maximization. One result of his model is that the firm directed by a utility maximizing manager produces the profit maximizing output. This outcome is obtained, however, with actual above-normal profit (πA), so that excess profit (πA — πR) is diverted to managerial preferences, for example, excessive staff, office perquisites, and excess compensation. This firm cannot be efficient. The value of diverted profit (πA — πR) is a measure of organizational slack, or X-inefficiency (Leibenstein, 1966). Although the firm produces the profit maximizing output under managerial utility maximizing decisions, it clearly does so inefficiently. This is shown in Figure 5.1.

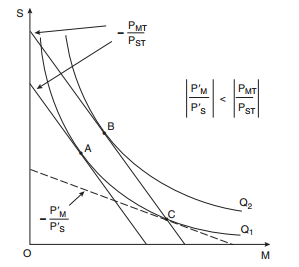

Figure 5.1.

Under the assumption of managerial utility maximization and the premise of separation of ownership and control, utility maximizing managers (M) have different input and compensation preferences, or expense preferences, than do profit maximizing shareholders (S). The manager, who has control rights, puts more weight on his or her preferences for inputs and compensation and relatively less weight on shareholder preferences. The implication of this is that to the manager, the opportunity cost of managerial preferences (PM‘) is lower than its true opportunity cost (PMT) and the opportunity cost of shareholder preferences (PS‘) is higher than its true opportunity cost (PST), so that [(PM‘)/(PS‘)] < [(PMT)/(PST)]. The manager produces the profit maximiz- ing output Q1 but chooses to do so at a higher cost point such as C in Figure 5.1 rather than at the true efficient profit maximizing point A. The manager’s decision on the allocation of resources within the firm effectively increases the cost of production. This, however, cannot be observed by shareholders who earn the normal reported profit (πR) which is acceptable to them but which is not the actual maximum profit possible (πA).

Given the true market values of the inputs and the true cost of firm operation (which is production cost plus (πA — πR) ), the firm could pro- duce output Q1 more efficiently than is accomplished at point C. The increased efficiency could be achieved by allocating resources according to shareholders’ preferences and either producing more output at the same cost (at B on Q2) than is currently produced at C or by producing the same output at lower per unit cost (at A on Q1).

How can this outcome be consistent with long run profit maximiza- tion? There are a number of possible interpretations. First, the higher profit possible at point B could only be a short run above-normal profit. In a competitive market this would induce entry until each firm’s out- put fell from output Q2 to output Q1 and profit would again return to the level of normal profit, which is the profit reported to shareholders in the model, output wR. Presumably, then, market competition solves the problem of managerial opportunistic behavior. Williamson does not comment on this possibility nor does he comment on the market struc- ture facing this managed firm. There is no requirement for monopoly power, however, either for managerial discretion or for his results. Apparently the managerial firm operates in a competitive market.

A second interpretation is that separation of ownership and control would exist in all firms in all markets. This situation would permit all managers of all firms in all markets to exercise managerial discretion of the type modeled here. In this case output Q1 would be the long run competitive output, shareholders would earn the long run normal (reported) profit (πR), and the inefficiency demonstrated at point C in Figure 5.1 would be a long run outcome. This appears to be the position taken by Williamson. Separation of ownership and control is inevitable and pervasive. The long run maximum profit is the actual profit (πA). This maximum profit is shared by shareholders (who receive wR), and the manager (who receives the residual, πA — πR). The manager’s share is obtained by exercising his or her legal control rights and the corre- sponding economic rights to obtain additional utility.

Thus, managerial expense preference cannot yield an efficient out- come even if it maximizes total profit. Efficiency with profit maximiza- tion requires a property rights system that channels the earned profit to the owners who make capital investment decisions and choose the cost minimizing input mix. The utility maximizing manager with legal control rights and effective economic rights does not choose the input mix that minimizes cost. The result is a long run competitive outcome with consistent organizational slack or X-inefficiency. The question remains, therefore, as Alchian (1969), and Fama and Jensen (1983a, 1983b) had asked, how can this situation of managerial inefficiency be a long run outcome?

Source: Carroll Kathleen A. (2004), Property Rights and Managerial Decisions in For-Profit, Nonprofit, and Public Organizations: Comparative Theory and Policy, Palgrave Macmillan; 2004th edition.