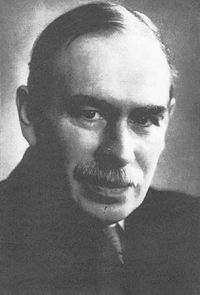

John Maynard Keynes is doubtlessly one the most important figures in the entire history of economics. He revolutionized economics with his classic book, The General Theory of Employment, Interest and Money (1936). This is generally regarded as probably the most influential social science treatise of the 20th Century, in that it quickly and permanently changed the way the world looked at the economy and the role of government in society. No other single book, before or since, has had quite such an impact.

John Maynard Keynes is doubtlessly one the most important figures in the entire history of economics. He revolutionized economics with his classic book, The General Theory of Employment, Interest and Money (1936). This is generally regarded as probably the most influential social science treatise of the 20th Century, in that it quickly and permanently changed the way the world looked at the economy and the role of government in society. No other single book, before or since, has had quite such an impact.

The son of the Cambridge economist and logician John Neville Keynes, John Maynard Keynes was bred in British elite institutions – Eton and then King’s College Cambridge. In 1906, he entered the British civil service for a little while, and then returned to Cambridge in 1909.

Three life-long connections were made during this time. Firstly, Keynes would remain a fellow of King’s College, Cambridge. Secondly, he became the editor of the Economic Journal in 1911, a position he would hold almost until the end of his life. He also fell in with the ‘Bloomsbury group’, a collection of upper-class Edwardian aesthetes such as Virginia Woolf, Clive Bell and Lytton Strachey, which would serve as his ‘life outside of economics’.

His first book on Indian currency (1913) was directly related to his experience at the India office. From 1914 to 1918, Keynes was called to the UK Treasury to assist with the financing of the British war economy. He excelled at his job and the influence he gained earned him a position with the British delegation to the Versailles Peace Conference in 1918. Keynes was appalled at the vindictive nature of the peace settlement, and was particularly opposed to the devastating consequences of the heavy ‘reparations’ payments imposed on Germany. He resigned from the conference and published his Economic Consequences of the Peace (1919), denouncing the Treaty of Versailles and bringing him into the public spotlight.

After returning to Cambridge, Keynes published his Treatise on Probability (1921), where he dismantled the classical theory of probability and launched what has since become known as the ‘logical-relationist’ theory of probability. Keynes’s work caused something of a stir, arousing the young Cantabrigian logician, Frank P. Ramsey, to outline his own ‘subjective’ theory of probability.

In 1923, Keynes published his Tract on Monetary Reform (1923), which was his contribution to the Cambridge cash-balance theory of money, then being developed by other Cambridge economists, Alfred Marshall, Arthur Cecil Pigou and DENNIS H. ROBERTSON. It was also in a 1923 newspaper article that he first proposed his ‘normal backwardation’ theory of hedging and speculation.

Throughout the 1920s, Keynes remained active in public policy debates, channeled mainly through his numerous articles in the Nation and Atheneum, a Liberal-Labor weekly magazine which he helped purchase in 1923 (it was absorbed by the New Statesman in 1931). The best of Keynes public policy writings was collected in his Essays in Persuasion (1931). He was on the forefront of the battle against returning Britain to the gold standard on a pre-war parity (e.g. 1925). This led him to author two famous pieces in condemnation of laissez-faire economic policy (1925,1926). In 1929, he wrote an election pamphlet with Hubert D. Henderson advocating the use of public works to reduce unemployment and condemning the Treasury’s fear of ‘budget deficits’. In 1929, he also entered into a small debate with Bertil Ohlin and Jacques Rueff on German reparations problem. He also found time to marry the Russian ballerina, Lydia Lopokova in 1925.

In 1930, John Maynard Keynes brought out his heavy, two-volume Treatise on Money, which effectively set out his Wicksellian theory of the credit cycle. In it, the rudiments of a liquidity preference theory of interest are laid out and Keynes believed it would be his magnum opus. His bubble was soon pricked. Friedrich von Hayek reviewed the Treatise so harshly that Keynes decided to set Piero Sraffa to review (and condemn no less harshly) Hayek’s own competing work. The Keynes-Hayek conflict was but one battle in the Cambridge-L.S.E. war.

The Treatise also led to the formation of a reading group, known as ‘the Circus’, composed of the young Cambridge economists Richard Kahn, Joan Robinson, Austin Robinson, James Meade and Piero Sraffa. Kahn dutifully delivered reports of the Circus’s discussions to Keynes, who subsequently began revising his ideas. One resulting criticism of the Treatise was that it failed to provide a theory of the determination of output and employment as a whole – a particular pertinent question given the huge amount of unemployment at the time.

The key was provided to Keynes in a short article by Richard Kahn (1931) – the theory of the income-expenditure multiplier – which was to be the basis of his future revolution. Already in a few 1933 articles and pamphlets, Keynes began announcing the new idea, and began submitting the drafts of his new book to the Circus and several fellow economists for review and dissection. His ideas on the marginal efficiency of investment took a little longer to work out.

In early 1936, the new book finally came out with the pretentious title of The General Theory of Employment, Interest and Money. Heavily anticipated, inexpensively priced and propitiously timed for a world caught in the grips of the Great Depression, the General Theory made a splash in both academic and political circles. As one American politician put it, everyone always knew that the economic policies recommended by the neo-classical economists were bad policies; but now they realized it was also bad economics.

With the General Theory, as it became known, Keynes sought to develop an theory that could explain the determination of aggregate output – and as a consequence, employment. He posited that the determining factor to be aggregate demand. Among the revolutionary concepts initiated by Keynes was the concept of a demand-determined equilibrium wherein unemployment is possible, the ineffectiveness of price flexibility to cure unemployment, a unique theory of money based on ‘liquidity preference’, the introduction of radical uncertainty and expectations, the marginal efficiency of investment schedule breaking Say’s Law (and thus reversing the savings-investment causation), the possibility of using government fiscal and monetary policy to help eliminate recessions and control economic booms. Indeed, with this book, he almost single-handedly constructed the fundamental relationships and ideas behind what became known as ‘macroeconomics’.

The Keynesian Revolution split the economics world in two generations: the young climbed over themselves to line up behind Keynes; the old rallied to condemn it. John Maynard Keynes responded to his most able critics – Jacob Viner, Dennis Robertson and Bertil Ohlin – in a series of 1937 articles, which helped him to expand upon some key aspects of his theory. A densely-written and difficult book, it was followed up immediately by elucidatory publications by the members of Keynes’s Circus, such as Joan Robinson, and young economists elsewhere in Britain, such as Roy Harrod and Abba Lerner.

Of particular importance was the 1937 article by John Hicks which introduced the IS-LM representation of Keynes’s theory that launched the ‘Neoclassical-Keynesian Synthesis’ that was to pervade in America (and elsewhere) as the dominant form of macroeconomics in the post-war era, particularly in the 1950s and 1960s. However, the so-called ‘Cambridge Keynesians’ – which included veterans of Keynes’s Circus, such as Joan Robinson – and their American cousins, the Post-Keynesian school, would dispute the “Synthesis” twist on the Keynesian Revolution. They posited up their own versions of the theory, which, they argued, was more faithful to Keynes’s original message.

Keynes’s health collapsed circa 1938, and, consequently, he ducked out of the debate which was then raging. When World War II broke out in earnest, Keynes re-emerged and published his 1940 pamphlet, How to Pay for the War. In that small tract, he identified the “inflationary gap” created by resource constraints during the war effort, and promoted the device of ‘compulsory saving’ and rationing to prevent price inflation, proposals that were adopted in 1941. The 1940 piece is notable for it provided the seeds of a theory of inflation to complement the ‘depression economics’ of the General Theory.

During the course of the war, Keynes was at the Treasury and set himself to think about the post-war economic order. In 1938, he had warmed up to Benjamin Graham’s proposals for an international ‘commodity-reserve’ currency to replace the Gold Standard. In 1943, Keynes forged his ideas for ‘Bancor’, a proposal for an international clearing union. In consultation with the Americans, Keynes eventually relented on his idea and accepted the American ‘White Plan’ for an international equalization ‘fund’ held in the currencies of the participating nations. However, several essential aspects of Keynes’s clearing union idea were incorporated.

In 1944, Keynes led the British delegation to the international conference in Bretton Woods where the details of the system were hammered out. The American ‘White Plan’ was accepted, countries would retain fixed exchange rates against the dollar, while the dollar itself would be matched to gold. Two institutions, the International Monetary Fund (IMF) and the World Bank (IBRD), were created to oversee the new international monetary system.

All these exhausting official missions and work taxed Keynes’s already precarious health. He died in 1946, soon after arranging the guarantee of an American loan to Great Britain.

Major Works of John Maynard Keynes

[Keynes was a prolific writer. The following list only includes Keynes’s books and better-known articles. His numerous anonymous and signed articles for Nation & Atheneum (N&A), Manchester Guardian Commercial, Reconstruction in Europe (MGCRE), The Listener, The New Republic, The New Statesman and Nation (NSN) and The Times are mostly omitted.]

– The Recent Economic Events in India, 1909, EJ

– Principal Averages and Laws of Error which Lead to Them, 1911, J of Royal Statis Soc

– Influence of Parental Alcoholism, 1911, J of Royal Statis Soc

– Irving Fisher’s Purchasing Power of Money, 1911, EJ

– W.S. Jevons’s Theory of Political Economy, 1912, EJ

– The Foreign Trade of the UK at Prices of 1900, 1912, EJ

– J.A. Hobson’s Gold, Prices and Wages, 1913, EJ

– Indian Currency and Finance, 1913

– Ludwig von Mises’ Theorie des Geldes, 1914, EJ

– The Prospects of Money, 1914, EJ

– War and the Financial System, 1914, EJ

– The City of London and the Bank of England, 1914, QJE

– Walter Bagehot’s Works and Life, 1915, EJ

– The Economics of War in Germay, 1915, EJ

– The Economic Consequences of the Peace, 1919

– Ralph G. Hawtrey’s Currency and Credit, 1920, EJ

– A Treatise on Probability, 1921

– Revision of the Treaty, 1922

– The Inflation of Currency as a Method of Taxation, 1922, MGCRE

– A Tract on Monetary Reform, 1923

– Some Aspects of Commodity Markets, 1923, Manchester Guardian

– A Reply to Sir William Beveridge’s Population and Unemployment, 1923, EJ

– Population and Unemployment, 1923, EJ

– The Measure of Deflation: an inquiry into index numbers, 1923, N&A

– Mr. Bonar Law, 1923, N&A

– Currency Policy and Unemployment, 1923, N&A

– Does Unemployment Need a Drastic Remedy?, 1924, N&A

– Edwin Montagu, 1924, N&A

– Alfred Marshall, 1842-1924, 1924, EJ and Memorials of Alfred Marshall, 1925

– Monetary Reform, with E. Cannan, Addis and Milner, 1924, EJ

– A Comment on Professor Cannan, 1924, EJ

– The Gold Standard Act, 1925, EJ

– The Balfour Note and Inter-Allied Debts, 1925, N&A

– The Economic Consequences of Mr. Churchill, 1925

– A Short View of Russia, 1925

– Am I a Liberal?, 1925, N&A

– The End of Laissez-Faire, 1926

– Liberalism and Labour, 1926, N&A

– Laissez Faire and Communism, 1926

– Francis Ysidro Edgeworth, 1926, EJ

– Trotsky on England, 1926, N&A

– A Note on Economy, 1927, N&A

– A Model Form for Statements of International Balances, 1927, EJ

– The British Balance of Trade, 1927, EJ

– The United States Balance of Trade, 1928, EJ

– Amalgamation of the British Note Issue, 1928, EJ

– Postwar Depression in the Lancashire Cotton Industry, 1928, J of Royal Statistical Society

– Lord Oxford, 1928, N&A

– The Great Villiers Connection, 1928, N&A

– Réflexions sur le franc, 1928

– The French Stabilisation Law, 1928, EJ

– Frederic C. Mills’ Behavior of Prices, 1928, EJ

– The War Debts, 1928, N&A

– A Rejoinder to Ohlin’s The Reparation Problem, 1929, EJ

– Can Lloyd George Do It?, with H.D. Henderson, 1929

– Winston Churchill, 1929, N&A

– A Treatise on Money, two volumes, 1930

– The Industrial Crisis, 1930, N&A

– The Great Slump of 1930, 1930, N&A

– Economic Possibilities for Our Grandchildren, 1930, N&A and Saturday Evening Post

– Frank P. Ramsey, 1930, EJ and 1931, NSN

– A Rejoinder to D.H. Robertson, 1931, EJ

– Spending and Saving, 1931, The Listener

– The Problem of Unemployment, 1931, The Listener

– On the Eve of Gold Suspension, 1931, Evening Standard

– The End of the Gold Standard, 1931, Sunday Express

– After the Suspension of Gold, 1931, Times

– Proposals for a Revenue Tariff, 1931, NSN

– Some Consequences of the Economy Report, 1931, NSN

– Essays in Persuasion, 1931

– The World’s Economic Outlook, 1932, Atlantic Monthly

– The Prospects of the Sterling Exchange, 1932, Yale Review

– The Dilemma of Modern Socialism, 1932, Political Quarterly

– Member Bank Reserves in the United States, 1932, EJ

– The World’s Economic Crisis and the Way of Escape with A. Salter, J. Stamp, B. Blackett, H. Clay and W. Beveridge, 1932

– Saving and Usury, 1932, EJ

– A Note on the Long-Term Rate of Interest in Relation to the Conversion Scheme, 1932, EJ

– A Monetary Theory of Production, 1933, in Festschrift für Arthur Spiethoff

– Mr. Robertson on Saving and Hoarding, 1933, EJ

– An Open Letter to President Roosevelt, 1933, New York Times

– The Means to Prosperity, 1933, Times

– National Self-Sufficiency, 1933, Yale Review

– The Multiplier, 1933, NSN

– Essays in Biography, 1933

– The Means to Prosperity, 1933

– Commemoration of T.R. Malthus, 1935, EJ

– The Future of the Foreign Exchange, 1935, Lloyds Bank Review

– William Stanley Jevons, 1936, JRSS

– Herbert Somerton Foxwell, 1936, EJ

– The Supply of Gold, 1936, EJ

– Fluctuations in Net Investment in the United States, 1936, EJ

– General Theory of Employment, Interest and Money, 1936

– The General Theory of Employment, 1937, QJE

– Professor Pigou on Money Wages in Relation to Unemployment, with N. Kaldor, EJ

– Alternative Theories of the Rate of Interest, 1937, EJ

– The Ex Ante Theory of the Rate of Interest, EJ

– The Theory of the Rate of Interest, 1937, in Lessons of Monetary Experience: In honor of Irving Fisher

– Some Economic Consequences of a Declining Population, 1937, Eugenics Review

– Comments on Mr. Robertson’s ‘Mr Keynes and Finance’, 1938, EJ

– Storage and Security, 1938, NSN

– The Policy of Government Storage of Foodstuffs and Raw Materials, 1938, EJ

– Mr. Keynes’s Consumption Function: A reply, 1938, QJE – reply to Holden (1938)

– Mr Keynes on the Distribution of Income and the Propensity to Consume: A reply, 1939, RES

– Adam Smith as Student and Professor, 1938, EJ

– Introduction to David Hume, An Abstract of a Treatise on Human Nature, with P. Sraffa, 1938

– James E. Meade’s Consumers’ Credits and Unemployment, 1938, EJ

– The Process of Capital Formation, 1939, EJ

– Professor Tinbergen’s Method, 1939, EJ

– Relative Movements of Real Wages and Output, 1939, EJ

– The Income and Fiscal Potential of Great Britain, 1939, EJ

– The Concept of National Income: Supplementary note, 1940, EJ

– How to Pay for the War: A radical plan for the Chancellor of the Exchequer, 1940

– The Objective of International Price Stability, 1943, EJ

– Mary Paley Marshall, 1944, EJ

– The Balance of Payments of the United States, 1946, EJ

– Newton the Man, 1947, Newton Tercentenary Celebrations, 1947

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Good post. I learn something totally new and challenging on websites I stumbleupon every day. It’s always helpful to read through content from other authors and use something from other websites.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I’ve truly enjoyed surfing around your blog posts. In any case I will be subscribing to your feed and I hope you write again soon!

Beautiful watch, arrived before i expected. Totally happy