1. The Downward Spiral

With the new analytical tools discussed above, hypercompetitive firms can use the New 7-S’s to seize the initiative. When a company using the New 7-S’s seizes the initiative, its competitor suffers a parallel loss of the initiative. Just as repeatedly seizing the initiative leads to a cycle of mo-mentum, repeated loss of the initiative can lead to a spiral of decline. Studies of corporate failures have identified these deepening spirals in advance of the bankruptcy of a firm.29

As Intel CEO Grove noted in a magazine article, “There is at least one point in the history of any company when you have to change dramatically to rise to the next performance level. Miss the moment, and you start to decline.”30 Grove has probably understated the challenge by saying companies reach this point at least once. In hypercompetition companies constantly face such challenges and critical moments. And if they miss these opportunities, they usually begin a downward spiral of decline. Figure 9-13 illustrates how use of the New 7-S’s can drive an opponent into paralysis and competitive surrender.

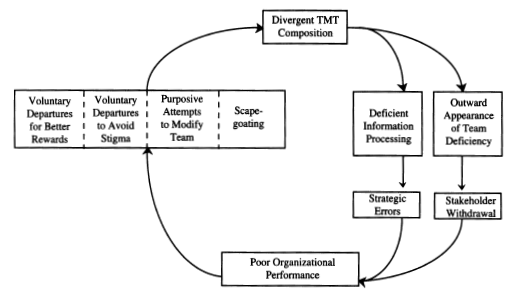

Disruption of the status quo causes performance declines that shock and confuse competitors, who often deny the real problem by dismissing the threat as temporary or “unfair.” As the shock and confusion deepen, top managers leave for numerous voluntary and involuntary reasons, creating a vicious circle of the type shown in Figure 9-14. As more team members leave, the information-processing capability of the team is disrupted, and the team develops holes that stakeholders (such as security analysts) point out as deficiencies. So stockholders get worried. These problems exacer bate the firm’s performance problems, continually generating further disruption of the top team.

Figure 9-15 illustrates how this downward spiral of decline also involves strategic errors that follow several phases. The original disadvan-tage, or loss of the initiative, leads to impairment and then a marginal existence. If the company has sufficient working capital and a buoyant environment, it can survive this marginal existence. But the company often experiences cycles of desperate strategic extremism and vacillation as it struggles to find a way out of this malaise. But rather than using a clearly defined strategy based on the New 7-S’s, the company is often so disrupted that it grasps at straws, a process leading to further internal turmoil.

FIGURE 9-13

HOW USING THE NEW 7-S’s CAN CAUSE THE OPPONENT

TO LOSE THE INITIATIVE

FIGURE 9-14

THE “VICIOUS CYCLE” OF TOP TEAM DETERIORATION AND POOR PERFORMANCE

Source: Reprinted by permission. From “Top Team Deterioration as Part of the Downward Spiral of Large Corporate Bankruptcies,” by Donald Hambrick and Richard D’Aveni, Management Science 18, no. 10, p. 1447. © 1992, The Institute of Management Sciences, 290 Westminster Street, Providence, RI02903.

If the company cannot revitalize itself by using the New 7-S’s, it slips from a state of marginal existence into a death struggle. Here it faces the conflicts created by its own vacillation on strategy. It also must cope with internal pressures created by a sharp decline in performance. Top managers often turn over rapidly as the company and its shareholders struggle to break the cycle. For some companies this is enough to lead them to failure. Others are hit with a sudden environmental decline or aggressive action by a competitor, which becomes the straw that breaks the camel’s back and leads to the ultimate failure of such firms.

With its loss of initiative, a company becomes a perpetual competitive laggard in each of the arenas of competition. As shown in Figure 9-13, it may try to play catch-up, to learn the new rules of the game and play as well as its attacker. But the attacker is always a step ahead of its competitor. As the competitor loses more and more battles, a sense of demoralization and malaise sets in. This affects the minds of employees and corporate leaders—the places where the knowledge-based advantage resides. The company and its employees begin to accept failure as inevitable or deserved. This leads to further decline, and unless action is taken to counteract this cycle, it results in retreat or exit by the attacked firm.

FIGURE 9-15

ORGANIZATIONAL DECLINE AS A DOWNWARD SPIRAL IN PHASES

Source: Donald Hambrick and Richard D’Aveni, “Large Corporate Failures in Downward Spirals,” Administrative Science Quarterly 33(1988): 14.

This disruption and decline is the ultimate goal of hypercompetitive behavior. This decline may mean the complete failure (bankruptcy) of the opponent, but it more likely means that the opponent will exit the market

or leave an opening for the firm to be preempted on the next dynamic strategic interaction. It is important to note, however, that driving one competitor into decline in no way eliminates the pressure to remain hypercompetitive. Other competitors may rise rapidly to take its place, and the first (vanquished) competitor may linger for a long time, causing trouble.

THREE POSSIBLE PATTERNS ASSOCIATED WITH LOSS OF THE INITIATIVE

As was just noted above, not every company ceases to exist as a result of this spiral of decline. Some of them, because of their own characteristics or their environment, linger on in varying states of disarray. They are damaged as aggressive competitors but not completely vanquished. There are three primary patterns of decline that are associated with loss of the initiative:

- Slow decline Like a cancer, the disruption and loss of the initiative slowly takes its toll on the company. This is a more likely response to strategic thrusts that don’t appear to be a serious threat. The decline and resulting psychological disruption of the loss of initiative slowly takes its toll on the company. It may divest itself of some of its once- strong businesses as decline slowly sweeps across it. This is also more likely in what seems to be a relatively benign environment (like a growth market), one which later turns out to be an illusion, having been captured by more hypercompetitive firms.

- Sudden collapse Like a stroke victim, the weakened company takes a dramatic turn for the worse. It then exits from the market or goes out of business suddenly. This is a more common response for smaller competitors or the victims of sudden and very aggressive hypercompetitive attacks. This reaction can also result when a financially weak firm is hit with a dramatic downturn in the business environment, causing permanent loss of initiative.

- Lingering Like a victim in a coma, the company has long since lost the initiative and acts as if it is now brain dead, even though it is still alive. Large companies with massive resources often have the ability to linger for long periods after their competitive abilities are weakened or disabled. Some of these lingering companies, however, manage to snap out of the coma and regain their position as aggressive competitors. Others eventually slip off into death.

2. Breaking the Spiral of Decline by Using the New 7’S’s

GM’s Saturn project is a good example of an attempt to use the New 7-S’s to break out of decline and regain the initiative. Satisfying customers (S-l) is the unequivocal goal at Saturn, and the entire organization has been designed around fulfilling that goal. It looked to emerging trends (S-2) in design, process, and customer demands. It used flexible manufacturing and unusual marketing methods to increase surprise (S-4). Saturn uses just-in-time delivery and sophisticated information-processing methods to increase speed (S-3). Saturn has surprised (S-4) its foreign competitors by creating a U.S.-made car that competes head-to-head on quality and reliability with foreign cars. It has shifted the rules of competition through establishing sales operations that use a fixed-price, no-haggling approach. It has used this shift in the rules as a selling point in its “a different kind of car, a different kind of company” advertising. This advertising and other signals have helped to discipline competitors by clearly going after buyers of Japanese cars. This initiative has been simultaneous with other GM projects to revitalize Buick, Cadillac, and Olds.

While Saturn has been very successful, the challenge now is how to transfer this newfound knowledge to the rest of the company. In contrast to Saturn, General Motors is a huge sleeping giant trying to transform itself into a hypercompetitive firm. Just as it is easier to establish an entrepreneurial start-up than it is to transform an existing firm into an innovative company, General Motors faced an easier task in starting up Saturn than in turning its entire organization into a Satum-like company. But small victories can provide the insights and inspiration for further success. Perhaps the key benefit of the Saturn project for General Motors is that it has demonstrated the value of approaches such as those embodied in the New 7-S’s, and it has done so much more forcefully than looking at an outside company could have. This has created a level of internal constructive disruption that could help General Motors transform itself into the world-class hypercompetitor that it once was.

The psychological dimension of this combat cannot be overemphasized. Small victories that can reverse the demoralization of the company can lead to much greater successes. For example, Motorola broke into the Japanese market with a small pocket pager. Although it was not a great victory, measured by scale, it was a major triumph for morale, and it destroyed the myth that the Japanese market could not be cracked. Motorola built on that success to become one of the most powerful U.S. competitors in Japanese markets and one of the most skillful players in the New 7-S’s. Similarly, Ford and Chrysler are now discovering that they can outpace Japanese quality standards and win with the Team Taurus and LH car/cab forward projects.

3. The Battle for the Mind of the Organization

Why do managers of large companies like IBM and Sears allow the downward spiral to persist when they could revitalize themselves by using the New 7-S’s? The key resource, is not strength of numbers or power, but rather morale, willpower, and knowledge. The battle is for the mind of the company. Reseizing the image is fundamentally rooted in the will, morale, and knowledge of how to manage the company’s dynamic strategic interactions with competitors. American corporations don’t lack power or natural and human resources to win. They lack the will to fight (due to being forced into malaise by hypercompetitive opponents) and the knowledge of how the game is played today.

This lack of will and knowledge can be compared with the revitalization of the U.S. military. Consider recent changes in military strategy and morale. In World War II the goal was to establish a beachhead and take the field by superior numbers or weapons. The United States tried to do this in Vietnam, but the strategy was foiled by intense guerrilla fighting. The United States Army was demoralized and even vilified as a result of its loss in Vietnam. When the United States entered the Persian Gulf War with Iraq, on the other hand, American strategy focused on disrupting command and control centers, attacking communications, and finding ways to surprise or reduce the responsiveness of the enemy. The United States broke the cycle of demoralization within the military by practicing this new approach through a series of small successes in Grenada and Panama that rebuilt morale and added to the military’s knowledge of how to win a modem war.

In the same way, large and sluggish U.S. firms such as General Motors and IBM were caught off guard by the unconventional strategies of foreign competitors. Suddenly the U.S. giants faced smaller competitors that created problems that could not be solved by throwing money at them. These challenges required a rethinking of how the business was organized. These once-dominant U.S. firms found themselves losing ground in the 1980s. This led to psychological disruption and loss of initiative, which they are working on regaining today. Because of their huge size, many of these firms persisted despite the beating they took in the marketplace. They were able to live long enough to rethink their strategies and change their directions, adopting many of the approaches outlined in the New 7-S’s.

Source: D’aveni Richard A. (1994), Hypercompetition, Free Press.