The behavioral theory of the firm first appeared in the 1963 book A Behavioral Theory of the Firm by Richard M. Cyert and James G. March. The work on the behavioral theory started in 1952 when March, a political scientist, joined Carnegie Mellon University, where Cyert was an economist. A behavioral model of rational choice by Herbert A. Simon paved the way for the behavioral model. Neo-classical economists assumed that firms enjoyed perfect information. In addition the firm maximized profits and did not suffer from internal resource allocation problems.

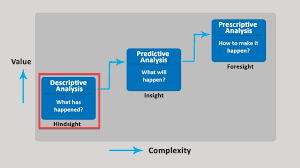

Advocates of the behavioral approach also challenged the omission of the element of uncertainty from the conventional theory. The behavioral model, like the managerial models of Oliver E. Williamson and Robin Marris, considers a large corporate business firm in which the ownership is separate from the management.

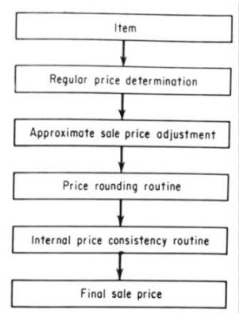

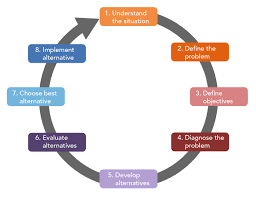

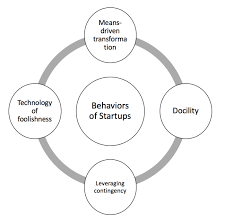

The behavioral approach takes the firm as the basic unit of analysis. It attempts to predict behaviour with respect to price, output and resource allocation decisions. It emphasizes the decision making process. The theory argues that while small firms may operate under the guidance of the entrepreneur, such a simple model does not describe larger corporations. These larger firms are coalitions of individuals or groups, which may include managers, stockholders, workers, suppliers and so on.

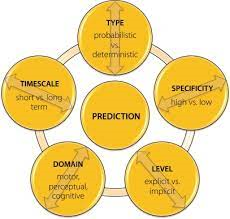

According to Cyert and March, these groups participate in setting goals and making decisions. Priorities and information may vary by group, potentially creating conflicts. Cyert and March mentioned five goals which real world firms generally possess: production; inventory; market share; sales and profits. According to the behavioral theory, all the goals must be satisfied, following an implicit order of priority among them.