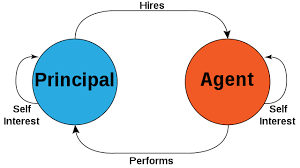

Agency theory is a principle that is used to explain and resolve issues in the relationship between business principals and their agents. Most commonly, that relationship is the one between shareholders, as principals, and company executives, as agents.

Main contentsSee more

KEY TAKEAWAYS

- Agency theory attempts to explain and resolve disputes over priorities between principals and their agents.

- Principals rely on agents to execute certain transactions, particularly financial, resulting in a difference in agreement on priorities and methods.

- The difference in priorities and interests between agents and principals is known as the principal-agent problem.

- Resolving the differences in expectations is called “reducing agency loss.”

- Performance-based compensation is one way that is used to achieve a balance between principal and agent.

- Common principal-agent relationships included in agency theory include shareholders and management, financial planners and their clients, and lessees and lessors.